We’re here to help you achieve your strategic objectives.

2025 J.P. Morgan Healthcare Conference Recap

Summary

Bailey & Company’s senior team was in San Francisco for the J.P. Morgan Healthcare Conference (JPM), January 13-15. We found the mood at JPM to be more optimistic than in 2024. There is always a decent amount of forced positivity in San Francisco in January, but we see a material difference this year in the ratio of talk to action. Bailey’s team was active during the conference with pitches, fireside chats, and meetings with prospects, sponsors, and partners. We expect a gradual acceleration of M&A activity throughout 2025, with a noticeable uptick in deals hitting the market around Q2.

Deal outlook

Expectations for deal activity in 2025 followed several overlapping narratives. These cumulatively should equate to a more active 2025 than 2024, but do not foretell a “rebound” or any sort of acute turning point in deal activity. The narratives we observed are as follows:

- Some companies have finally grown into the multiples they traded at in 2021, and are therefore ready to transact.

- Also at long last, some sponsors are ready to capitulate on pricing and accept a lower multiple in order to post DPI or, in the case of an older vintage already in carry, in order to wind down the fund and move on.

- Based on 1 and 2, we expect deal announcements from several long-in-the-tooth sponsor-backed companies over the next few weeks and months. A few others will be in market imminently.

- The number of processes launched at JPM was not particularly high. However, pitch activity is up materially since the start of the year, which portends a good number of processes launching around Q2.

- In the growth-stage technology ecosystem, many lower-quality companies traded or folded over the past year; as a result, the quality of companies in the market is up, on average. Outside of a few splashy AI announcements, the VC ecosystem remains depressed, and this is continuing to push those VC-backed companies still standing toward greater financial discipline.

Recaps and other creatively structured deals, as opposed to full trades, are still very much on the table for sponsors holding aging assets, but somewhat less talked about than last year. We heard little discussion of continuation vehicles. We tally both of these observations as positive signals for M&A activity.

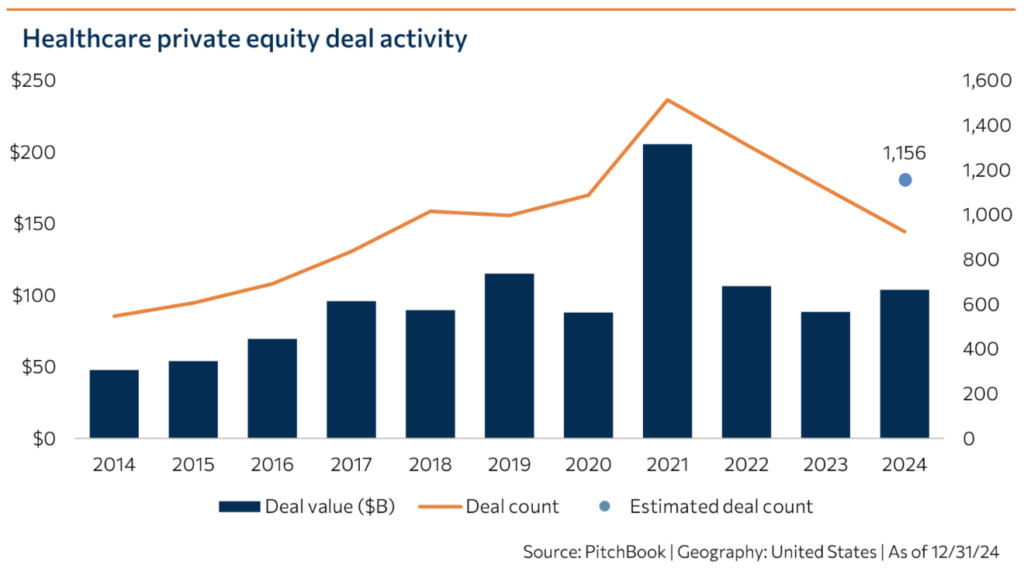

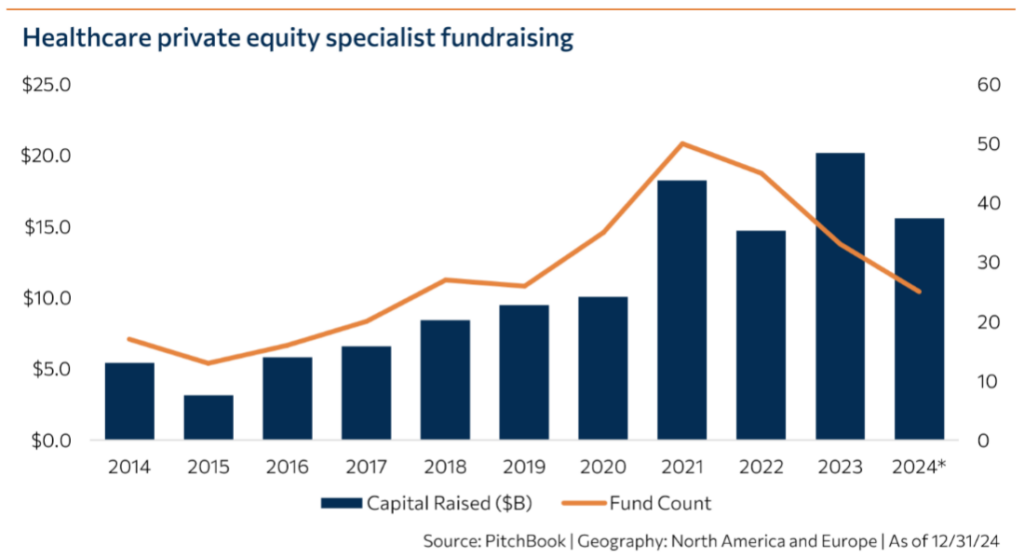

While exits remain the top priority, we equally heard sponsors express frustration around how difficult it was to put capital to work over the past year or so. There are a few dynamics at play here. The first and most obvious is that approximately $75 billion in US-based, healthcare-earmarked dry powder has been chasing a very modest pipeline of high-quality deals; sponsors had to make aggressive bids or, as one GP put it, get “blown out of the water.” This dynamic will ease only gradually in 2025. Second, healthcare private equity fundraising has become increasingly concentrated among a handful of firms moving rapidly upmarket. These firms are growing into new playbooks with larger check sizes, or in some cases are setting aside sleeves within their funds for specialized strategies at smaller check sizes. Third, some firms that index heavily on thematic investing have begun broadening their apertures due to the lack of reasonably priced targets. Effectively, this means that investors are under pressure to develop domain expertise and relationship networks in a broader set of industry niches, and are likely to lean on third parties (operating executives, consultants, and of course investment banks) to achieve this.

Regulatory and macroeconomic environment

In stark contrast to last year’s conference circuit, there was relatively little discussion of the regulatory environment at JPM. The incoming administration is broadly expected to be less hawkish on antitrust, and the HHS’ report on “Consolidation in Healthcare Markets,” released on Wednesday in response to the tri-agency request for information announced in March, barely registered on conference attendees’ radar. Reports of a few upcoming technocratic CMS appointments, including Chris Klomp, former CEO of Collective Medical, as Medicare head and Abe Sutton of Rubicon Founders as CMMI director, further quelled nerves. The new normal of headline risk around private equity investment in healthcare provider deals has already been baked into investors’ level of appetite, or lack thereof, for direct care delivery assets (discussed below).

Massachusetts’ newly signed pre-transaction reporting law is a reminder that the state-level regulatory environment continues to bear monitoring. The Massachusetts law broadly resembles existing legislation in California, Oregon, and Indiana in that it significantly increases disclosure requirements around healthcare private equity transactions, but should not otherwise threaten a deal’s ability to close. The reappearance of a more aggressive legislative approach that takes aim at MSO structures and/or subjects transactions to attorney general approval – similar to the bill vetoed by California governor Gavin Newsom last year – is likely in Oregon and possible in Indiana in 2025.

Interest rates were little discussed. Again, the market appears to have acclimated (once again) to expectations of a higher-for-longer rate environment. We do think that the worst-case scenario – in which inflation returns (e.g., due to an aggressive tariff regime) and the Federal Reserve is forced to raise interest rates – would create enough uncertainty to delay deals coming to market.

Subsector dynamics and themes to watch

Healthcare IT

Most private equity healthcare investors are currently spending considerable time in healthcare IT. Bailey & Company’s recently published report on governance, risk, and compliance—a growing picks-and-shovels technology category where we expect M&A activity this year—has generated significant interest. Revenue cycle management (RCM), especially specialty RCM, continues to be red-hot, with several deals announced during the week and more expected to hit the market in the first half of the year. In general, outsourced services (ranging from truly tech-enabled to managed IT to professional services) into the provider end market are attracting significant investor interest as an alternative to direct investment into providers.

In software, investors remain wary of point solution risk, especially in any category adjacent to the EHR within the health system end market. We see significant opportunities—including a good pipeline of growing middle market companies—in payer tech and tech-enabled services. In particular, we think that the current disruption in Medicare Advantage has the potential to accelerate growth for companies that help payers improve member engagement, star ratings, risk scoring accuracy, and care gap closure.

There is also strong interest in the employer end market, although investors have experienced difficulty sourcing opportunities other than TPAs that do not suffer from significant point solution risk. Transcarent’s take-private of Accolade at a less than 1.5x TTM revenue multiple underscores how even a company with around $450 million in revenue can be effectively subscale in this market. We are also tracking considerable buzz around individual contribution health reimbursement account (ICHRA) administration. Stay tuned for a report out next month.

Pharma tech and services

The topic du jour of last year’s JPM, pharma services remains on most sponsors’ wish lists but has also proven difficult to enter due to a shortage of high-quality assets in the market. Depending on the customer base, some pharma services companies continue to see volatility in their contract pipelines as sponsors cancel trials. As reported by news outlets, the overall mood in the life sciences ecosystem at JPM was not optimistic outside of AI and obesity drugs—a similar story to the one analysts were telling last year. However, we expect competition for high-quality pharma tech and services assets to remain high in 2025.

Commonly cited areas of interest remain similar to what we heard throughout 2024 and include technologies and tech-enabled services that enable clinical trials, commercialization, consulting, CDMOs (especially medtech), and pharmaceutical supply chain. Following significant M&A activity in hub services over 2024, we think patient access more broadly is a key area to watch for 2025. We heard less about site management organizations this year than in 2024, probably because many of the sponsors that were developing trial site theses a year ago found themselves boxed out by high valuations on a small number of available targets.

Healthcare services

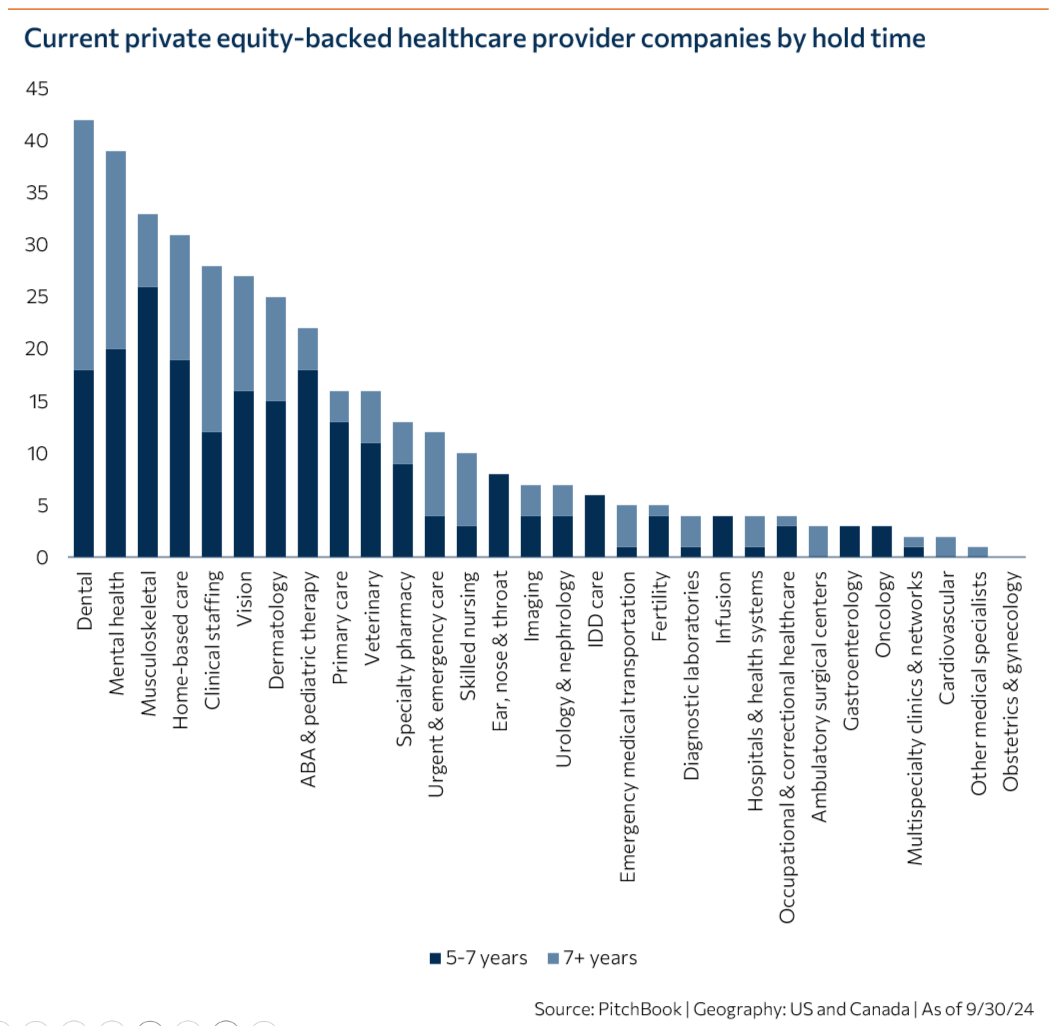

Around 225 healthcare provider groups in the US and Canada have been held by private equity for five years or more, compared with around 100 in healthcare IT and around 70 in pharma tech and services. As a result, it is not a question of if provider deal activity will pick back up, but when. We believe that many healthcare provider groups that struggled with labor cost inflation in 2022 and early 2023 have at least seen that dynamic stabilize, and that some of the operational issues, such as lack of integration, that tripped up platforms that tested the market over the past two years are gradually being corrected. Strategics also continue to be active. (Optum is quietly on a provider buying spree.)

Activity in home-based care has been picking up gradually over the past year or so, first in private duty and more recently in hospice. Behavioral health in various flavors (chiefly PHP/IOP, outpatient mental health, and autism) also remain on many sponsors’ wish lists. Infusion remains red-hot and highly desired. A less frothy but just as frequently talked about provider category – which we flagged in our 2025 outlook note – is services into post-acute facilities, or “SNFists.” We expect this to be an active space in 2025.

Our conversations with sponsors around PPMs took one of three tracks. Some firms are not interested in physician groups, full stop. Others (probably a smaller number) are still willing to look at PPMs, and a few are actively looking for opportunities, trying to run against the grain. This is an improvement from last year, when the sentiment was almost exclusively negative. The challenge for sponsors seeking value in PPMs will be settling on a multiple that the seller (physician or sponsor) is willing to accept. Valuation disagreements will be especially difficult to bridge because many investors have started to take a more conservative approach to physician earn-outs and seller equity rollover, given the problems with retention that many platforms saw over the past few years.

Select deal announcements before and during JPM week

- Ascend Capital Partners acquired a majority stake in Unison Therapy Services from Ridgemont Equity Partners. Ridgemont created Unison, a provider of therapy and behavioral health services to children and school- and community-based settings, by merging several companies in 2021.

- Branford Castle Partners acquired Eastern Dental from Staple Street Capital for around an 8x multiple on $7-9 million EBITDA, per reports.

- Court Square Capital Partners and WindRose Health Investors acquired home infusion provider Soleo Health from H.I.G. Capital for a reported $1.1 billion.

- Hippocratic AI raised a $141 million Series B led by Kleiner Perkins at a post-valuation of $1.64 billion. The company’s generative AI agents are currently making calls to patients of its partner organizations.

- Innovaccer raised a $275 million primary and secondary Series F with participation from Capital Group, Banner Health, Danaher Ventures LLC, Generation Investment Management, Kaiser Permanente, and M12. The company has raised $675 million in total and stated it has grown revenue by 50% year-over-year for the past five years.

- InTandem Capital Partners invested in Healthfuse, a RCM vendor management business previously backed by New Capital Partners and Fidus Capital.

- Leavitt Equity Partners and Fulcrum Equity Partners invested in Pediatrics Plus, a multispecialty pediatric therapy platform offering physical, occupational, speech, and ABA therapy.

- MedTrainer and Propelus, two leading companies in healthcare workforce and compliance, announced a partnership that combines MedTrainer’s credentialing workflow solutions with Propelus’ Data Solutions primary source verification and exclusion technology.

- New Mountain Capital announced three investments during JPM week. First, the firm invested in Union Healthcare Insight; Robert Musselwhite, former CEO of Advisory Board, OptumInsights, and Definitive Healthcare, will partner with the company.

- Second, New Mountain Capital announced it will acquire Machinify, an AI-driven claims editing solution, and merge it with the three payments companies New Mountain acquired in September 2024: The Rawlings Group, Apixio’s payment integrity business, and VARIS.

- Third, New Mountain Capital invested in Access Healthcare, a RCM company.

- Revelstoke Capital Partners invested in Omega Systems, a provider of managed IT and cybersecurity services, an area that has been active over the past year.

- Vesey Street Capital Partners carved out ComplexCare Solutions, which provides health assessments and member engagement services to health plans, from Inovalon.

- In its earnings call, Walgreens Boots Alliance announced it had commenced selling its VillageMD stake. The company also beat analyst expectations, quelling rumors of a wholesale take-private by Sycamore Partners or another private equity sponsor.

- WindRose Health Investors completed an investment alongside management in Collaborative Imaging, a radiology MSO, to form CIVIE.

ABOUT BAILEY & COMPANY

Bailey is a Nashville-based merchant banking platform focused on growth and late-stage healthcare and technology companies. Through the firm’s M&A advisory and strategic fund businesses, Bailey supports strong management teams that have built scalable platforms by providing strategic insights, world class advice, and access to one of the most diverse networks of industry experts. Since our founding, our senior bankers have closed over 200 transactions representing more than $17B in value. For more information see: www.bnco.com.