We’re here to help you achieve your strategic objectives.

A Bull Case for Value-Based Care Tech and Services in 2025

Summary

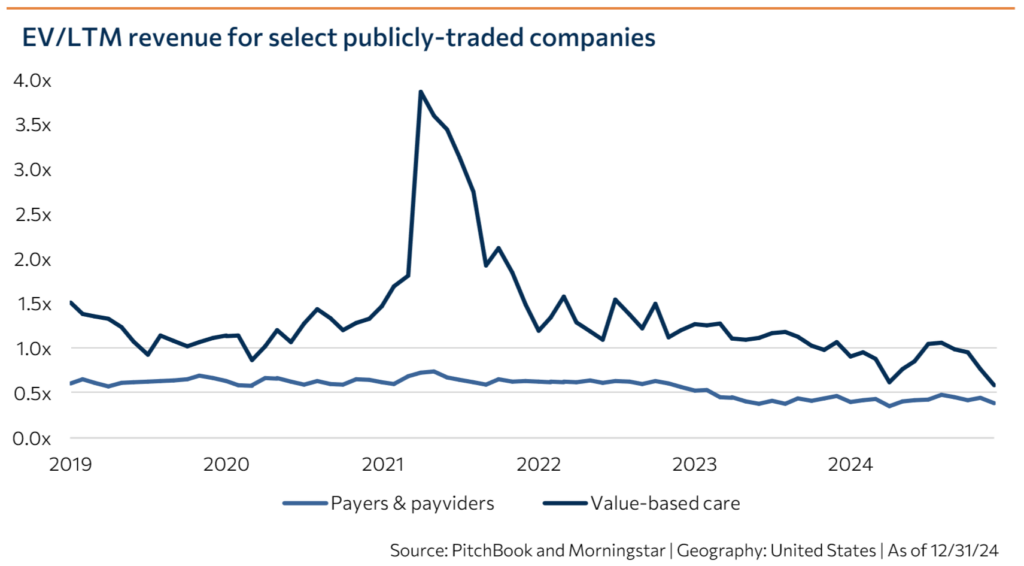

Value-based care (VBC) – a buzzword just a few years ago – is now viewed with skepticism by many investors. Some companies grew too quickly during the bubble of 2020-2022 and could not manage the risk they took on. Retailers, once seen as a major disruptive force within VBC that could help democratize access to care, have largely (but not universally) slowed or reversed course on their primary care bets. Program design, policy changes, and utilization trends have made various VBC pathways economically less attractive for payers and, in turn, risk-bearing providers. Nowhere has this been felt more acutely than in Medicare Advantage (MA) – historically the most lucrative VBC program – where a perfect storm of policy changes and other exogenous factors has converged.

However, we think now is the right time to make a contrarian play in VBC. Specifically, there are signs that demand for VBC tech and tech-enabled services will increase significantly in 2025 as MA plans grapple with increased utilization and member churn, and as winning plans scale up to rapidly take market share.

A market correction in MA

To understand the present opportunity in MA, it is important to understand the forces that have squeezed plan margins over the past few years. These include the following:

- The v28 risk adjustment framework, which is two-thirds phased in for the 2025 plan year, has had varied effects on plans depending on population characteristics, but decreases risk adjustment factors by 4% on average compared with v24 overall. This translates to an average $418 per-member-per-year decrease in risk-adjusted premiums.

- Changes to the RADV audit implemented in 2023 increased plans’ exposure to potential CMS clawbacks of historical overpayments due to upcoding.

- Adjustments to the calculation of star ratings have resulted in declining ratings on average since 2022. In 2025, only 62.1% of members are enrolled in a plan rated four stars or higher, down from 89.5% in 2022. The new methodology generally places greater weight on patient experience and preventative care. CMS estimates its 2026 Proposed Rule will result in a .069% decrease in quality bonus payments, a steeper decline than in 2025.

- Utilization was unexpectedly and persistently high during 2024, resulting in elevated medical loss ratios. This is thought to be due to lagged effects of delayed care during the COVID-19 pandemic, higher acuity levels, rising prescription drug costs, and demographic changes.

- Providers are increasingly challenging utilization management by MA plans. Fifty health systems terminated MA plans in Q4 2024, and 14 disputes did not reach a timely resolution – both record numbers.

Although policy experts agree that MA generally enjoys bipartisan support and key appointees of the Trump administration, most notably Mehmet Oz, have spoken enthusiastically about the program, observers believe that Congress may continue to scrutinize and pare back MA plan margins, including via additional changes to the risk adjustment framework, over the coming years as Republicans seek to rein in government spending. Because of this correction in the MA market, carriers are dropping or shrinking plans at an unprecedented clip – causing those plans that remain to inherit members rapidly. This should increase demand for technology and services that can help plans understand, engage, and manage those members effectively, all while bracing for further economic headwinds.

Unprecedented MA membership churn expected in 2025

For the first time in the history of the MA program, the number of general enrollment MA plans available decreased by 2% for 2025 compared with 2024. Full plan terminations for 2025 are affecting around 1.4 million MA members (4.2% more than 4x last year’s rate), including six MA carriers fully exiting the market in 2025. Service area reductions are affecting a further 1.6% of members. The number of plans offering vision, hearing, fitness, OTC, acupuncture, nutrition, transportation, and in-home support supplemental benefits decreased between 2024 and 2025, while only dental coverage (already offered by over 97% of plans) and telehealth services saw an increase.

As a result of these changes, MA plans are seeing an unprecedented level of member churn. The average MA plan disenrollment rate was around 17% in 2021, up from 10% in 2017. We have heard (though have not been able to verify) one industry estimate that the MA churn rate for plan year 2025 is expected to be much higher than that, around 40%. As members lose coverage under their previous plan, the remaining plans are inheriting members rapidly – we have heard anecdotes of plans inheriting tens of thousands of members or more than doubling in size.

Implications of member churn

While membership growth is of course desirable, rapid and unexpected growth can have challenging implications. Unlike new enrollees aging into the program – who are 65 and therefore younger and healthier by definition than the average Medicare beneficiary – plan switchers can be any age, with any level of chronic illness, social risk, etc. Their conditions may not have been well managed by the previous plan.

Visibility into the population of new members “inherited” from other plans is low. In addition to the MA open enrollment period from mid-October through early December, MA members can switch between plans or move onto traditional Medicare between January 1 and March 31. This means that plans still do not know what their final PY 2025 membership will look like. As membership crystallizes, plans will engage in new member outreach, encourage members to complete self-assessments, and work to collect historical medical records via health information exchanges. They will try to ensure new members complete annual wellness visits and are appropriately risk-coded in the process, and will deploy care management and social determinants of health (SDOH) resources for vulnerable members they identify. All told, plans may not have a robust view of the health of their new members until the second half of 2025. Another dynamic to watch is the shift from PPO to HMO plans. The large national carriers – United, CVS, Humana, and Centene – were disproportionately represented in plan terminations for 2025, with these four companies comprising 70% of terminated members. Moreover, around 70-80% of these members were in PPO plans. We have anecdotally heard that many members are now switching from PPO to HMO plans due to PPO plan terminations in some markets. This necessitates an extra layer of member engagement to attribute new HMO plan members to a primary care provider.

Increased demand for VBC tech-enabled services

Our conversations with market participants indicate that this disruption has resulted in significant demand for third-party solutions that can help payers scale up rapidly to engage and manage new members. Areas of particular interest include:

- Vendors that provide member activation and member engagement services, such as DUOS, and Carenet. Software and services may include omnichannel communications, annual wellness visits, screenings, and connecting members with supplemental benefits and third-party SDOH resources.

- Companies that specialize in providing in-home health assessments, annual wellness visits, and care navigation services to enable follow-up gap closure and accurate HCC capture, including Care Connectors Medical Group, Easy Health, Homeward, and incumbents Matrix Medical Network and Signify Health.

Solutions like these increase plans’ visibility into their members’ needs and help activate appropriate medical or supplemental services. This, in turn, delivers improved patient outcomes, lower costs, more accurate HCC coding, and improved star ratings via increased member satisfaction as measured by HEDIS and CAHPS performance.

Innovation opportunity

VBC is labor-intensive. The cost and scale-up challenges of staffing patient or member engagement, management, navigation, and preventative care programs put a ceiling on VBC expansion for many organizations. We believe that advancements in data interoperability, workflow automation, and AI – including large language models – are creating opportunities to improve the efficiency of VBC services organizations as well as payers and providers that build in-house patient/member engagement and care management teams.

For instance, Arkos and Guidehealth, two VBC enablement companies that work with payers and risk-bearing providers, respectively, to provide engagement services and care gap closure, are among the organizations piloting Hippocratic AI’s virtual agents that can autonomously make calls to patients to record biometric readings. Taking another approach, Jaan Health’s Phamily product uses AI to significantly increase the efficiency of provider organizations’ care management and chronic condition management programs, allowing human staff to support 5-10x the number of patients.

Elevated utilization has put pressure on payers and risk-bearing providers to control costs and improve outcomes via care coordination, medication management, network design, and referral management. This in turn necessitates investment in data infrastructure that provides real-time insight into the patient journey and seamlessly connects payer and provider data. For instance:

- Point-of-care decision support tools such as AmalgamRx, Holon, Navina, and Vim can nudge providers toward optimal care pathways and referrals and support HCC coding. Many “traditional” VBC enablement companies that aggregate providers and take on risk in value-based contracts offer similar tools; Pearl Health stands out as an example of an organization known for its proprietary point-of-care tech.

- Data and analytics platforms such as Arcadia, Clarify, and Innovaccer can aid in high-quality network design by surfacing insights into provider quality, referral patterns, leakage, and unexplained variation, while tools like VitalData Technology unify disparate data sources to guide and automate payer workflows for care management, utilization risk adjustment, quality improvement, and care gap closure.

Payers have also focused for the past few years on modernizing their technology stacks, replacing point solutions and home-grown tech with integrated platforms, and reducing administrative expenses. It will be interesting to see how these dynamics interact with current imperatives to engage members, improve star ratings, and control utilization. Tech-forward vendors that can provide services efficiently, at scale, and with robust integration capabilities should come out ahead.

Looking ahead

Will the current disruption in MA persist in 2026 and beyond? One possibility is that once carriers have rationalized their plan offerings, they will focus more on trimming benefits and increasing premiums, which could lead to further member churn. It is also important to remember that star rating payments are made two years after the measurement year, so plans are only beginning to feel the financial effects of lower star ratings on average in 2023 and 2024. The 2025 performance year could be even more challenging for star ratings due to the difficulty of engaging and managing newly enrolled members. Additionally, if left intact by the Trump administration, the Part D redesign component of the Inflation Reduction Act is set to begin implementation in 2026. This will materially increase MA plans’ exposure to catastrophic prescription costs. For these reasons, we expect MA payers to remain highly focused on member engagement and care management for the next few years.

CONTACT INFORMATION

Jeff Bailey

Co-Founder & Managing Director

Steven Harris

Managing Director

Rebecca Springer

Director, Market Development

RELEVANT TRANSACTIONS

has been acquired by

Undisclosed

Financial Advisor to Care Connectors Medical Group

has received growth capital from

Undisclosed

Financial Advisor to Reveleer

ABOUT BAILEY & COMPANY

Bailey is a Nashville-based merchant banking platform focused on growth and late-stage healthcare and technology companies. Through the firm’s M&A advisory and strategic fund businesses, Bailey supports strong management teams that have built scalable platforms by providing strategic insights, world class advice, and access to one of the most diverse networks of industry experts. Since our founding, our senior bankers have closed over 200 transactions representing more than $17B in value. For more information see: www.bnco.com.