We’re here to help you achieve your strategic objectives.

Bailey & Company 2024 Wrap and 2025 Outlook

Key Takeaways

- Below, we review highlights from a year of unprecedented growth for Bailey & Company, including significant hires and appointments and transaction highlights.

- We outline predictions for healthcare M&A in 2025, including an easing of antitrust and headline risk pressures, continued strategic M&A activity, a gradual reversal of fortunes for PPMs, and elevated levels of deal activity in healthcare IT, payer tech and services, and pharma tech and services.

- Finally, we highlight four subsectors we’re keeping an eye on for 2025: governance, risk, and compliance (GRC), ICHRA administration, SNFists, and value-based care. Stay tuned for our first deep-dive research release in early January.

2024 in Review

2024 was a pivotal year for Bailey & Company, marked by rapid strategic growth. With eleven managing directors across four offices, Bailey is now one of the largest middle-market healthcare investment banks and is active across four key verticals: healthcare services, healthcare IT, payer tech and services, and pharma tech and services.

This year, we built on a nearly 20-year track record of leading advisory to middle-market companies by not only expanding our team and leadership, but investing in institutional foundations to broaden sector coverage, enhance our engagement with sponsors, and provide differentiated value to our partners and clients.

New hires and office locations

- In May, Tim Scallen was appointed CEO of Bailey & Co. Tim joined Bailey in 2020 and previously served as COO. Prior to Bailey, he was an investor at TT Capital Partners, Norwest Equity Partners, and Sankaty Advisors (now Bain Capital Credit).

- In June, we announced a significant expansion of our banking team with the addition of four managing directors: James Castro, James Metcalf, Andrew Hewlett, and Ben Matz. All four joined from B. Riley.

- Alongside this team expansion, we opened offices in Los Angeles and New York, two markets integral to the firm’s long-term growth. Nashville continues to be the firm’s epicenter.

- In November, we hired Rebecca Springer to build a differentiated thought leadership platform to enhance our value-add for sponsor and corporate clients. Rebecca was previously lead healthcare analyst at PitchBook.

We have also grown our junior and mid-level banking team. All told, we grew headcount by 60% during the year and continue to hire as we enter 2025.

Transaction highlights

The Bailey & Company team is rounding out a strong 2024 with a number of successful closed transactions. Some key highlights included:

Bailey acted as the exclusive financial advisor to The Surgical Clinic, a physician-owned multispecialty surgical practice, in its sale to One Oncology. The Surgical Clinic offers care in general surgery, surgical oncology, bariatric surgery, breast surgery, vascular and endovascular surgery, veins, plastic surgery, and podiatry across seventeen clinic locations in Tennessee and Kentucky.

SocialClimb, which offers patient satisfaction, reputation management, and revenue growth solutions for healthcare provider organizations, sold to RLDatix, with Bailey acting as SocialClimb’s exclusive financial advisor. SocialClimb’s marketing solutions represent a strategic extension of the patient safety, outcomes, and compliance value chain where RLDatix is a leader.

Bailey & Company served as the exclusive financial and strategic advisor to Care Connectors Medical Group, a tech-enabled value-based care platform, in a majority recapitalization led by Epilog Partners. Care Connectors provides essential primary care, evaluation, and follow-up coordination services for Medicare Advantage members, primarily in the home.

Claims Eval, a national provider of peer review and utilization review services, sold to Ethos Risk Services, a leading claims investigation and medical management services company, with Bailey & Company as the exclusive financial and strategic advisor. Claims Eval offers evidence-based review services for carriers, third-party administrators, managed care organizations, and self-insured employers.

Looking ahead, we are entering the new year with a robust pipeline, with more than 30 active engagements across all four of the firm’s coverage areas.

2025 Healthcare M&A Outlook

As we close 2024, healthcare M&A continues to operate in an environment of fiscal and regulatory uncertainty. In many respects, the market remains risk-off, yet many buyers and sellers who sat on the sidelines through the downturn in deal activity of the past year and a half are reactivating or preparing to do so in the new year. Moreover, we are seeing new investment opportunities emerge driven by secular themes such as employer healthcare cost pressures, care model innovation, and data unification. Below are some of our market predictions heading into the new year.

Antitrust and headline risk pressures around PE investment in healthcare providers will ease in 2025.

2024 saw an unprecedented level of regulator, policy, and public attention to PE investment in healthcare delivery, as well as a hawkish antitrust regime under the FTC across sectors. Although the Trump administration will not be completely lax on antitrust issues—and further regulatory action is likely in specific states, such as Indiana and Oregon—we anticipate that the spotlight will shine less intensely on PE’s role in healthcare in 2025 than in 2024. PE-owned companies comprise less than 4% of the US healthcare provider ecosystem, per a PitchBook estimate.[1] The winding down of the Steward Health Care saga and media narrative shift toward healthcare payers, PBMs, and pharmaceutical companies (and therefore away from PE) will contribute to this shift in attention.

Direct effects from regulator involvement in PE healthcare transactions will continue to be concentrated in specific states, most notably California, where the state’s Office of Health Care Accountability (OHCA) review process has elongated transaction timelines and, in some cases, deterred sellers altogether. And because numerous advocacy groups, some of which emerged within the past year, will continue to be interested parties in PE healthcare regulation, proactive stakeholder engagement by PE healthcare investors remains crucial.

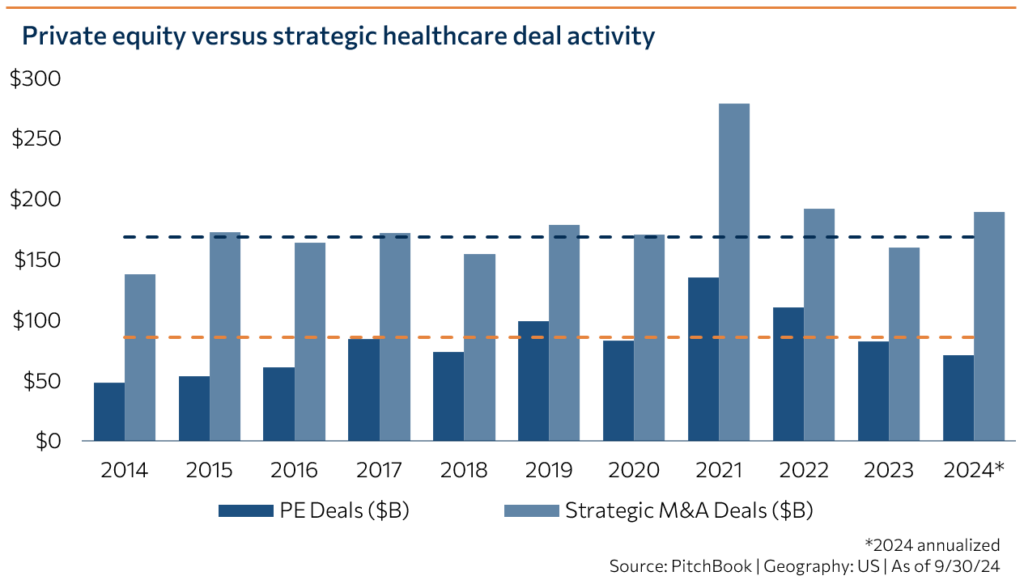

Large strategics will continue to be active in M&A.

For much of 2024, a narrative was circulating through the market that strategic buyers had retrenched. This was not really accurate except with reference to certain subsets of strategics (most notably retailers). What was true was that review timelines for larger deals involving strategics were, and continue to be, extremely long, even if the deal itself was not seriously under threat. Payviders and distributors have been active through late 2024, and some digital health companies that were able to financially course-correct over the past two years are planning to reactivate their M&A programs in 2025.

On the nonprofit side, health system M&A continues to focus on scale and rationalization. Regulators have made it more difficult for systems to increase their market concentration through M&A, so scale typically means linking adjacent but distinct geographies. In terms of rationalization, strong outsourcing trends in revenue cycle management, 340B pharmacy, and biomedical services should continue to create attractive opportunities for managed service companies.

The market’s negative sentiment on PPMs will begin to gradually reverse by the end of 2025.

This will have several catalysts. First, continued strategic M&A activity will provide encouragement that terminal exits are possible, at least in some specialties. Second, some middle-market sponsors will continue to place bets in less consolidated categories, such as podiatry, pain, ENT, and pediatrics, leading to platform consolidation opportunities up-market.

Third, by the end of the year, many of the PPMs that were in poor operational and financial health in 2022-2023 will have regrouped and will be ready to return to market, on sounder footing and/or with some capitulation on pricing. At this point, some investors will have grown weary of elevated valuations for healthcare IT and pharma services assets, and will begin to turn back to PPMs as a (relative) value play.

At the end of the day, it comes down to the numbers: there are currently over 200 PE-backed healthcare provider businesses that have been held for five years or more in the US and Canada,[2] and there is about $75 billion in PE dry powder earmarked for US healthcare.[3] We think that those investors who continue to invest in PPMs going forward will pay more attention to integration and will take a more conservative approach to physician compensation.

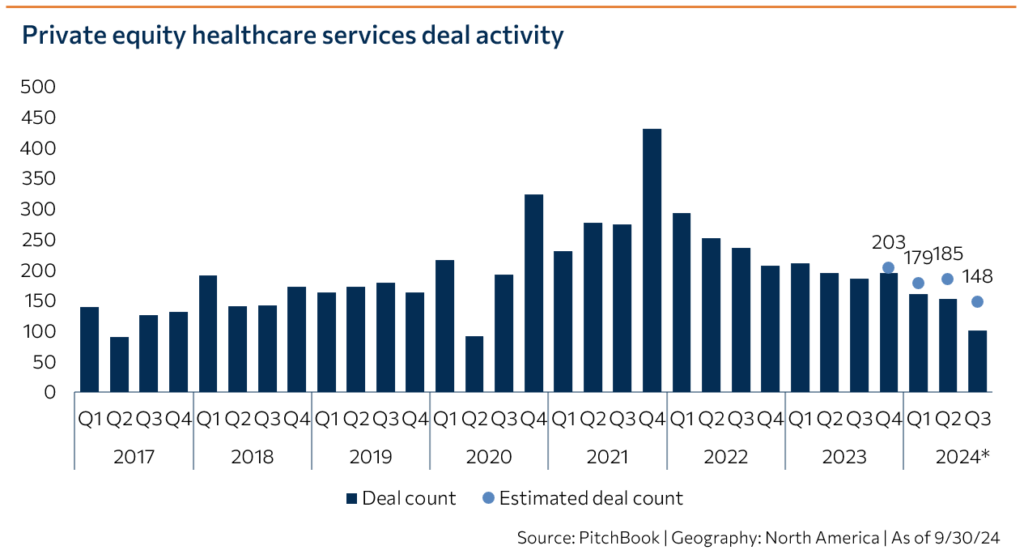

Healthcare IT, payer tech and services, and pharma tech and services will continue to be extremely active in 2025.

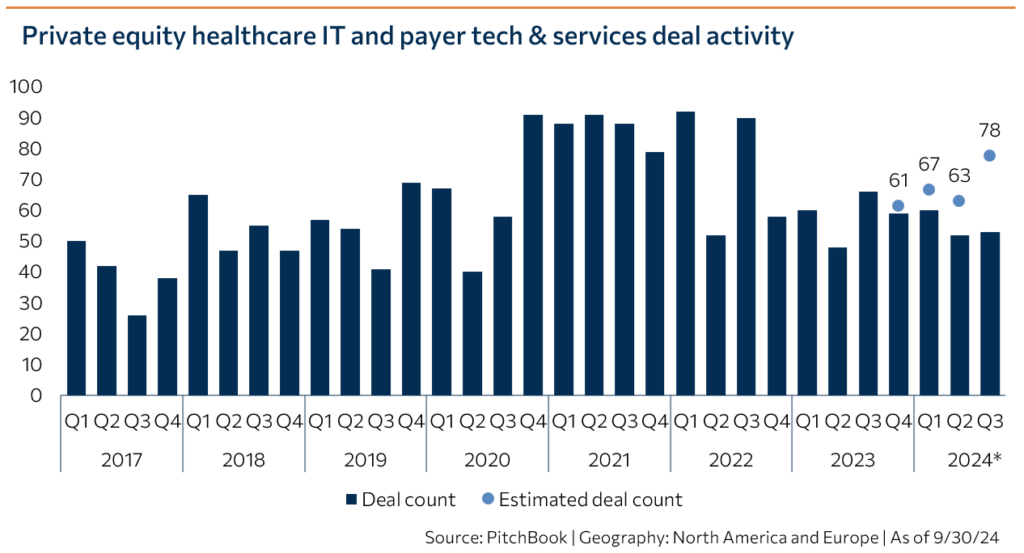

Deal activity in these segments shot up to near-record levels in Q3 2024, according to PitchBook.[4] In healthcare IT, we expect sponsors to dial in on opportunities to knit together point solutions and fragmented services into scaled platform plays, with the VC-backed ecosystem increasingly yielding buyout opportunities.

In payer tech and services, investors will turn to the ACA and employer-sponsored markets as a haven from stroke-of-the-pen risk. They will also find opportunities to invest in solutions that help payers grow membership and stay ahead of a rapidly changing regulatory environment in Medicare Advantage.

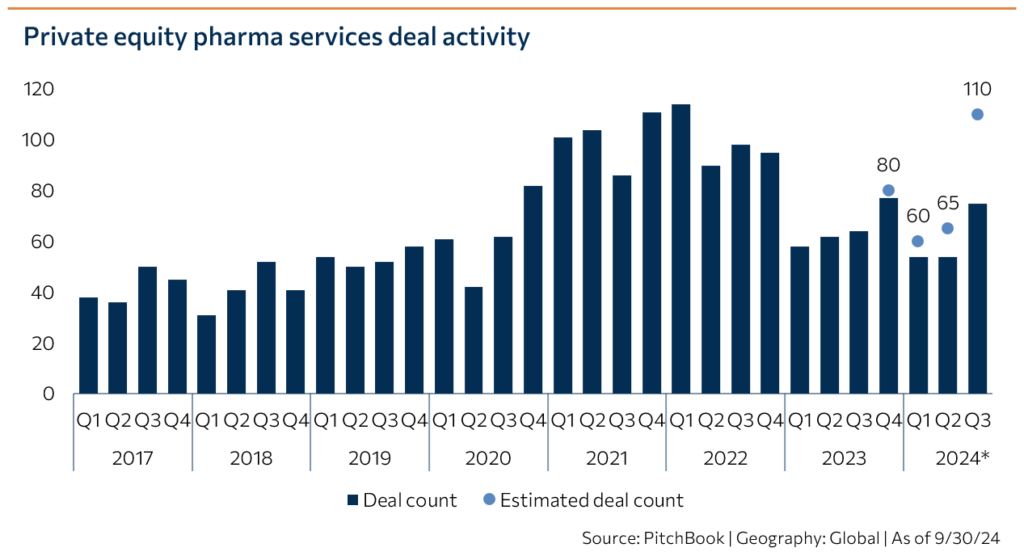

Finally, as pharmaceutical companies continue to show a willingness to outsource to practically any solution that can reduce cost and time-to-market, most healthcare PE investors, as well as advisors and service providers, are actively trying to grow their footprints in pharma tech and services, and we foresee more activity to come as a result.

Sectors we’re watching for 2025

Bailey & Company’s dedicated research platform and investment banking professionals are tracking the following sectors and more for 2025. Stay tuned for our first deep-dive research release in early January.

Governance, risk, and compliance (GRC). GRC encompasses mission-critical functions such as provider data and directory management on the payer side, and provider credentialing, continuing education, and patient safety on the provider side. These functions tie directly to revenue (member experience and stars ratings; reducing the time it takes for a provider to become billable) as well as to insurance costs that can reach nine figures annually or more for large health systems. GRC is a market that has already seen a first wave of consolidation that failed to deliver on the full promise of an integrated healthcare operations platform. With second-generation point solutions now gaining meaningful traction, we see compelling opportunities to unify siloed datasets and workstreams through M&A.

Individual contribution health reimbursement account (ICHRA) administration. Easily the buzziest topic du jour, ICHRA plans allow employers to contribute pre-tax dollars to an HRA which employees then use to purchase a plan of their choosing on the ACA exchanges. Pre-tax ICHRAs were enabled by a final rule that went into effect in 2020. They are particularly attractive to small- and medium-sized employers because they provide a clear line of sight to medical spend for the upcoming year. The ICHRA market is small (around 500,000 enrolled at present[5]) but growing at around 30% year-over-year.[6] Thatch and Remodel Health, two VC-backed platforms that streamline ICHRA administration, have raised large funding rounds in the past four months. On the payer side, Centene and Oscar have gone all in on ICHRA plans, and many others are actively investigating.

SNFists. Post-acute and long-term care facilities are increasingly contracting with provider groups that specialize in offering primary care, therapy, behavioral health, end-of-life care, and other services. Care by SNFists (a term coined via analogy to “hospitalist”) can reduce readmission rates and allows facilities to increase their post-acute/Medicare patient census. The SNFist landscape remains fragmented, and we see opportunities for groups to expand service line offerings across the continuum of care within their existing facility footprints, and to unlock additional upside via value-based models focused on high-risk populations.

Value-based care. Value-based care can hardly be considered in vogue for 2025, as economic changes to Medicare Advantage and post-pandemic utilization surges have pushed some risk-bearing providers into financial distress. However, investors would be wise not to abandon the space. In particular, we see an opportunity for tech-enabled service providers to gain market share by helping payers navigate a volatile competitive landscape. As plans pull out of some markets, those left behind must rapidly scale up to engage, risk score, and manage significant new member populations.

[1] https://pitchbook.com/news/reports/q3-2024-pitchbook-analyst-note-quantifying-pe-investment-in-healthcare-providers

[2] https://pitchbook.com/news/reports/q3-2024-healthcare-services-pe-update

[3] Bailey analysis of PitchBook data

[4] https://pitchbook.com/news/reports/q3-2024-pharma-services-pe-update; https://pitchbook.com/news/reports/q3-2024-healthcare-it-pe-update

[5] https://secondopinion.media/p/ichra-is-gaining-momentum-and-if-so-what-does-it-mean-for-health-tech

[6] https://www.hracouncil.org/report

ABOUT BAILEY & COMPANY

Bailey is a Nashville-based merchant banking platform focused on growth and late-stage healthcare and technology companies. Through the firm’s M&A advisory and strategic fund businesses, Bailey supports strong management teams that have built scalable platforms by providing strategic insights, world class advice, and access to one of the most diverse networks of industry experts. Since our founding, our senior bankers have closed over 200 transactions representing more than $17B in value. For more information see: www.bnco.com.