We’re here to help you achieve your strategic objectives.

Aesthetics, Plastic Surgery & Private Equity Market Update

OVERVIEW

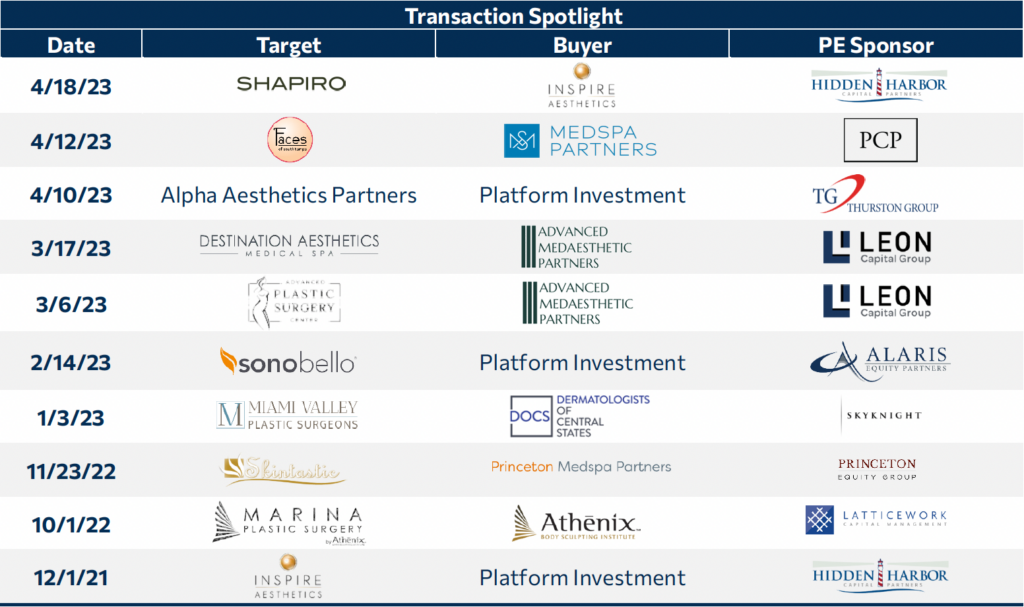

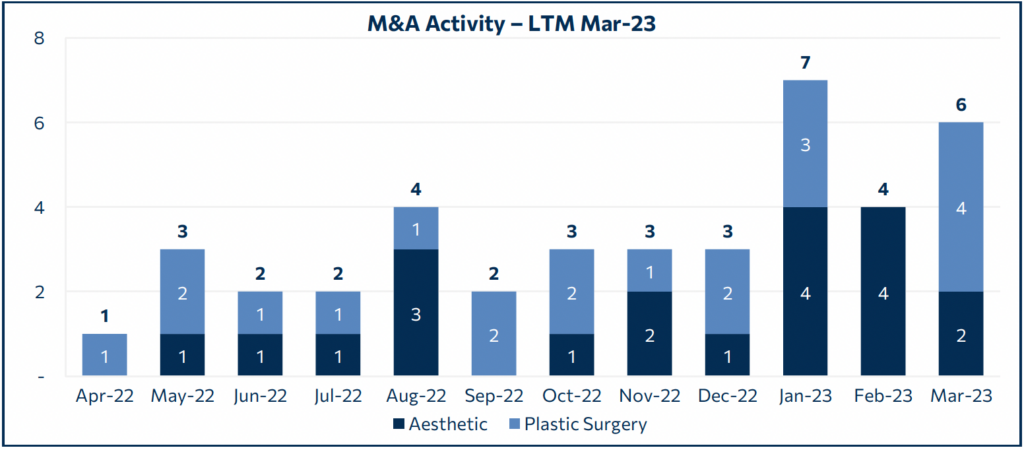

The aesthetics and plastic surgery industry, which includes surgical and non-surgical cosmetic procedures, has experienced strong growth in recent periods and is poised to continue its current trajectory as cosmetic care becomes more popular and patients begin to allocate greater portions of their disposable income to these treatments. Many of these procedures are non-invasive and include treatments such as Botox and Dysport injectables, Juvederm facial fillers, and NovaThreads thread lifts. This patient base has also shifted to a younger population, usually under 50 years old, as an emphasis on proactive care has been placed over reactive care. This is a result of providers choosing to treat patients before the effects of aging as opposed to after wrinkles and marionette lines occur. Additionally, these treatments are recurring and result in a sticky patient base receiving routine procedures. This exponential growth has caught the attention of large private equity groups, leading to a rapid consolidation of both larger and smaller independent groups. As such, M&A activity over the last year has increased from one transaction in April 2022 to seven transactions in January 2023. One highlight includes Alaris Equity Partners’ $500M+ investment in Sono Bello, an operator of aesthetic surgery centers, in February 2023.

INDUSTRY:

The combined aesthetic and plastic surgery market was approximately $60B in 2022 and is poised for significant growth moving forward. This continued expansion will be driven mainly by the aesthetic industry which is forecasted to grow at a 14.5% CAGR through 2025. The plastic surgery market, which is the largest component of the combined industry, is further set to increase to over $40B by 2030 from $26.6B in 2022. The growth is largely being driven by the increasing popularity of elective procedures and recognized health benefits for various previously undiagnosed or untreatable conditions.

Aesthetics:

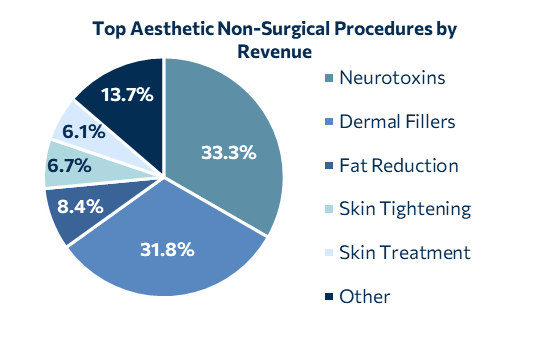

- Aesthetic procedures generated $10B in revenue in 2021

- Of these procedures, 88% were female patients and of these patients, 52% were between 35 and 54.

- 65% of non-surgical cosmetic patients are repeat customers

- The average patient spends $500 per visit, up over 20% from 2019.

- 31% of the aesthetic industry patient base are between 51 – 64 years old.

Plastic Surgery:

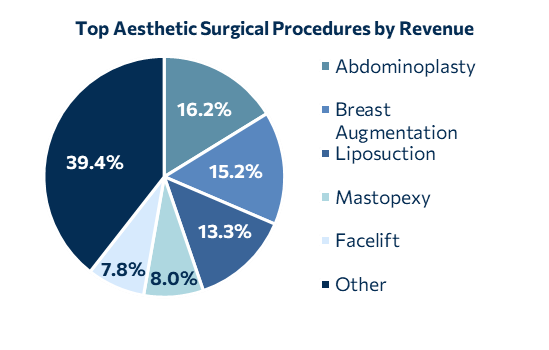

- Plastic surgery industry revenue grew 35% from 2020 to 2021.

- This amounted to over 11.1M procedures in 2021.

- On average, plastic surgeons performed over 320 surgical procedures in 2022.

- 35% of women who have had one procedure expect to have another.

- 25% of the plastic surgery patient base is between the age of 17 and 35.

MARKET:

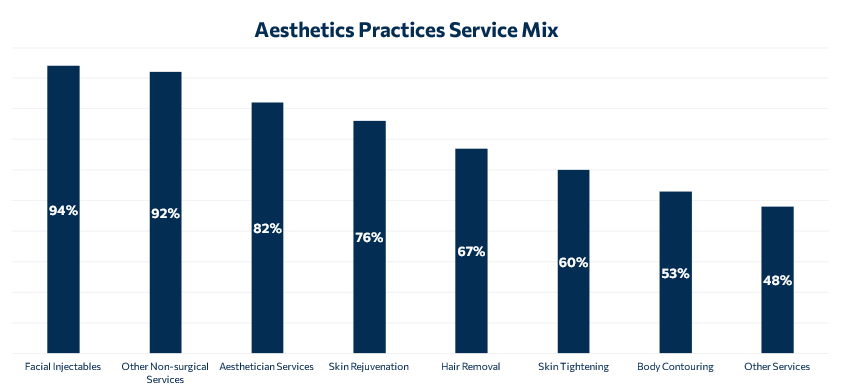

The aesthetic and plastic surgery M&A market has been increasingly active in the last 12 months as over 25 strategics across the two industry verticals scramble to acquire smaller groups across the US. Practices are being evaluated on their distinct, diverse service offerings, payer mix, market position, and geographic location. Stand alone, multi site groups that offer a variety of services have proven to peak buyer interest, and ultimately, yield favorable valuations. Additional premiums have been placed on practices that have embraced recent technological developments within the industry that improve patient recovery time and results

CONTACT INFORMATION

Stephen Scott

Managing Director

Richard Jacques

Managing Director

Phillip Knotts

Managing Director

Russell Bryan

Managing Director

ABOUT BAILEY & COMPANY

Bailey is a Nashville-based merchant banking platform focused on growth and late-stage healthcare and technology companies. Through the firm’s M&A advisory and strategic fund businesses, Bailey supports strong management teams that have built scalable platforms by providing strategic insights, world class advice, and access to one of the most diverse networks of industry experts. Since our founding, our senior bankers have closed over 200 transactions representing more than $17B in value. For more information see: www.bnco.com.

ABOUT BAILEY & COMPANY

Bailey is a Nashville-based merchant banking platform focused on growth and late-stage healthcare and technology companies. Through the firm’s M&A advisory and strategic fund businesses, Bailey supports strong management teams that have built scalable platforms by providing strategic insights, world class advice, and access to one of the most diverse networks of industry experts. Since our founding, our senior bankers have closed over 200 transactions representing more than $17B in value. For more information see: www.bnco.com.