We’re here to help you achieve your strategic objectives.

Cardiology PPM & Private Equity Market Update

OVERVIEW

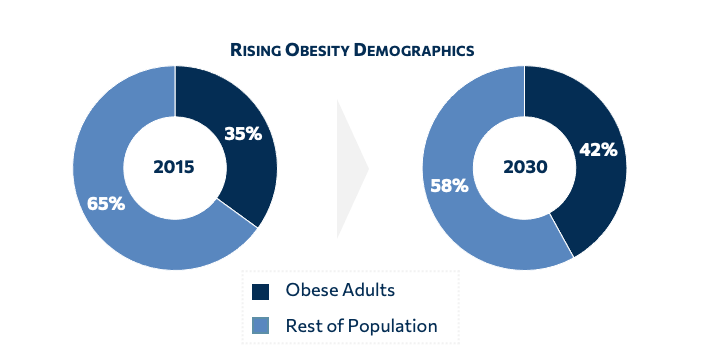

As Americans continue to live longer with increased rates of obesity, cardiologists are benefiting more than most from increased demand and the prevalence of less-invasive procedures in an outpatient setting. The typical cardiologist’s patient panel is largely comprised of overweight individuals under the age of 60 and those over 65, the fastest growing age bracket. This demographic alone is expected to be greater than 70 million people by 2030, of which 70% are expected to suffer from some form of cardiovascular disease (“CVD”). Recent CMS regulation now provides coverage to cardiology procedures performed in ambulatory surgery center (“ASC”) and cardiac catheterization laboratory (“cath lab”) environments. Such treatments include heart catheterizations, coronary interventions, and pacemaker implants allowing for nearly 60% cost savings when compared to an in-patient hospital setting. Since nearly 70% of cardiologists are employed by health systems, there remains a lack of attractive independent acquisition targets, driving up valuation multiples in the sector. All these influences result in cardiology remaining one of the fastest growing areas of private equity focus as the larger platforms and other new entrants work to acquire these scarce practices.

INDUSTRY:

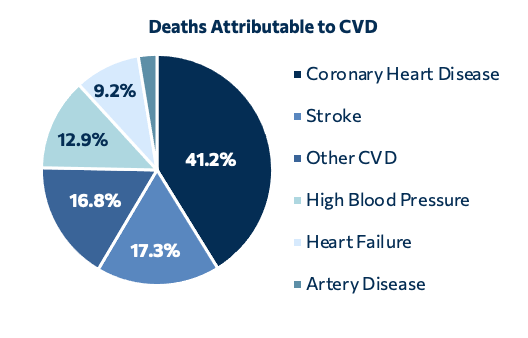

The total cardiology industry market size is approximately $50B and there is expected to be a $650B total direct cost associated with CVD by 2025. Much of this is the result of heart disease being the leading cause of death in the United States. This continued trend will largely be driven by the aforementioned demographic developments and the growing elderly population.

- Cardiology specific ASCs grew from only 18 in 2017 to over 90 in 2019.

- There are over 1,700 cath labs in the US.

- According to the American Heart Association, CVD accounted for >928K deaths in 2020.

- In 2021, more people died of heart disease than of cancer and COVID-19.

- There are over 2M stent implant procedures performed each year.

- >40% of the American population is expected to have heart disease by 2030.

- The CDC estimates that 47% of adults have hypertension.

- 33% of adults have prediabetes, according to the National Institute of Health.

- 75% of adults are obese, according to the CDC.

MARKET:

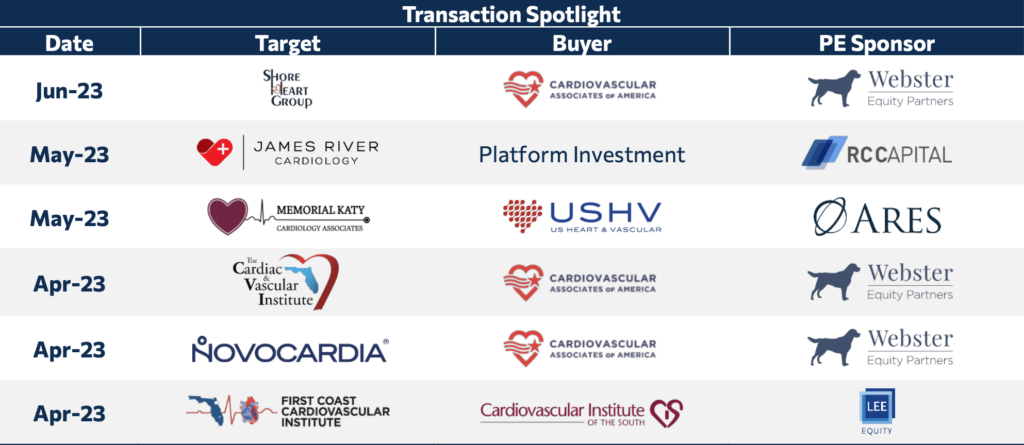

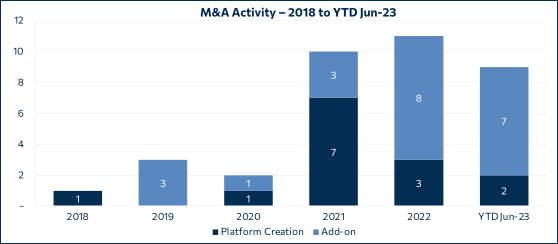

The M&A market has been fueled by both strategic add-on acquisitions as well as platform investments. Bailey & Company has found that large valuation premiums have been placed on practices that provide multiple subspecialties of cardiology. Ideally, businesses will have multiple providers who perform general and interventional procedures along with additional providers who perform specialized treatments such as electrophysiology care. Furthermore, buyers favor targets that own at least one ASC or cath lab, with a preference towards ASC ownership as catheterization procedures can be completed in an ASC setting and the inverse is not true for ASC procedures performed in a cath lab.

CONTACT INFORMATION

Stephen Scott

Managing Director

Richard Jacques

Managing Director

Russell Bryan

Managing Director

Phillip Knotts

Managing Director

ABOUT BAILEY & COMPANY

Bailey is a Nashville-based merchant banking platform focused on growth and late-stage healthcare and technology companies. Through the firm’s M&A advisory and strategic fund businesses, Bailey supports strong management teams that have built scalable platforms by providing strategic insights, world class advice, and access to one of the most diverse networks of industry experts. Since our founding, our senior bankers have closed over 200 transactions representing more than $17B in value. For more information see: www.bnco.com.

ABOUT BAILEY & COMPANY

Bailey is a Nashville-based merchant banking platform focused on growth and late-stage healthcare and technology companies. Through the firm’s M&A advisory and strategic fund businesses, Bailey supports strong management teams that have built scalable platforms by providing strategic insights, world class advice, and access to one of the most diverse networks of industry experts. Since our founding, our senior bankers have closed over 200 transactions representing more than $17B in value. For more information see: www.bnco.com.