We’re here to help you achieve your strategic objectives.

ENT (Otolaryngology) PPM & Private Equity Market Update

OVERVIEW

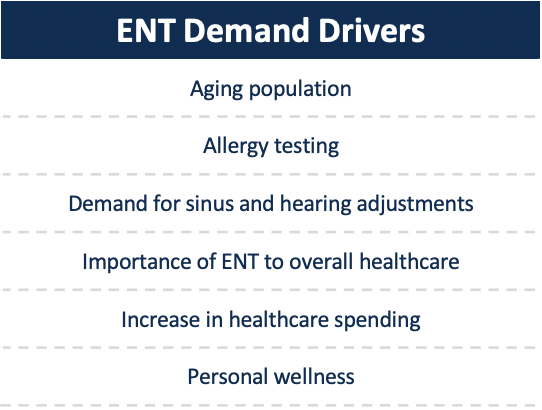

Over the last six years, the Ear, Nose, and Throat sector has continued to be an area of strategic buyer focus. Otolaryngologists (“ENTs”) are trained in the treatment of diseases and disorders of the ear, nose, and throat and related structures of the head and neck. Other related areas of focus include Otology, Rhinology, Larynology, head and neck disorders, plastic and reconstructive surgery, and pediatric care. ENTs work closely with various other specialties (Ophthalmology, Dermatology, Oncology, among others) to ensure coordinated care across the continuum through value-based care (“VBC”) arrangements. The primary tailwinds driving growth in the sector include the increasing aging population and the growing prevalence of allergy and asthma cases at the patient level. The sector is additionally benefiting from procedures shifting away from hospital settings to ASCs due to the reduced costs of care. Other strong demand drivers include an increase in healthcare spending and elevated attention to personal wellness.

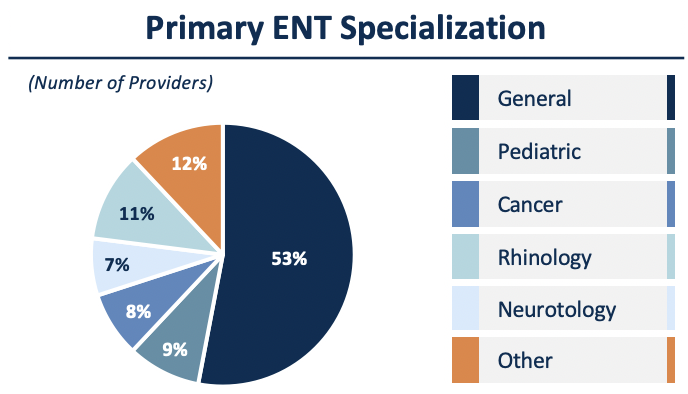

Consolidation within the industry, fueled by mutual buyer and seller interest, remains in its early stages. PE and strategic buyers are looking to capitalize on consistent cash flows and independent practices are looking for support with back-office functions including administrative tasks, to focus on patient care. Additionally, selling to a larger group offers providers access to more favorable payor contracts and the ability to reduce costs with greater purchasing power. Both strategic and financial buyers continue to be enticed by industry fragmentation with over 50% of physicians practicing outside of health systems and most practices maintaining less than 25 providers. Furthermore, ENT ASCs are highly profitable when compared to other specialties motivating a continued push by PE-backed ENT platforms to ASC-based care. ENT assets also offer consolidators various ancillary revenue expansion opportunities such as allergy testing, audiology, and hearing devices.

INDUSTRY:

There are currently 12,600 practicing ENTs in the United States and an estimated $30.2B global market size which has a 5.5% CAGR through 2028.

- Common ENT procedures performed in an ASC cost 50% less than those performed in a hospital setting.

- ENTs perform nearly 13% of all ASC procedures.

- ENT ASC procedures are 76% more profitable than other high-volume ASC specialties.

- There are 24M people with asthma in the US, including 6M children.

- According to Medscape, performing bureaucratic tasks is a top cause of ENT burnout.

MARKET:

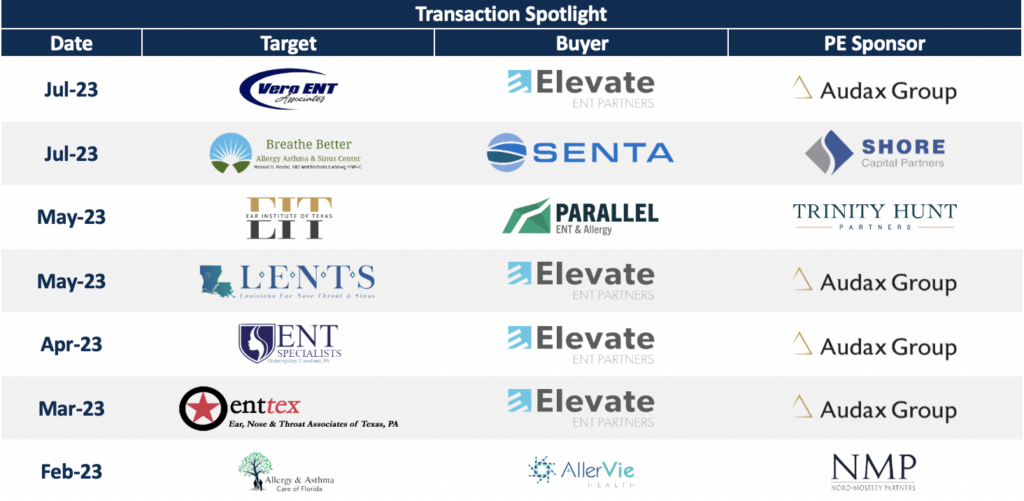

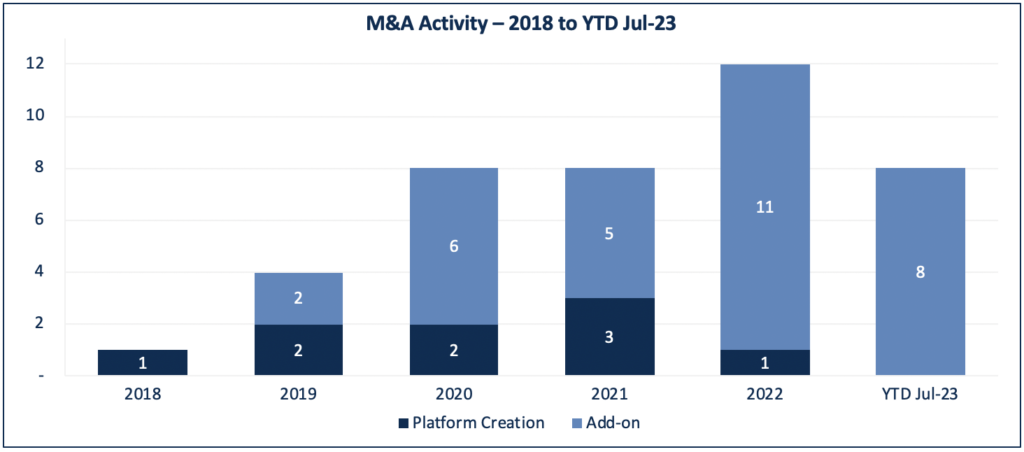

With limited market consolidation, there remain abundant actionable acquisition targets with PE groups focusing on larger independent practices and strategic groups looking for add-on targets lacking access to capital and back-office sophistication. Of late, the most active buyers include large strategics Elevate ENT Partners and AllerVie Health backed by Audax Group and Noro-Moseley Partners, respectively, of whom have completed multiple add-on transactions this year. Platform deals continue, as well, with Trinity Hunt launching Parallel ENT & Allergy in July 2022. Of note, consolidation has been centered in southern states such as Texas, Louisiana, and Florida with few deals occurring outside of these geographies.

CONTACT INFORMATION

Stephen Scott

Managing Director

Richard Jacques

Managing Director

Phillip Knotts

Managing Director

Russell Bryan

Managing Director

ABOUT BAILEY & COMPANY

Bailey is a Nashville-based merchant banking platform focused on growth and late-stage healthcare and technology companies. Through the firm’s M&A advisory and strategic fund businesses, Bailey supports strong management teams that have built scalable platforms by providing strategic insights, world class advice, and access to one of the most diverse networks of industry experts. Since our founding, our senior bankers have closed over 200 transactions representing more than $17B in value. For more information see: www.bnco.com.

ABOUT BAILEY & COMPANY

Bailey is a Nashville-based merchant banking platform focused on growth and late-stage healthcare and technology companies. Through the firm’s M&A advisory and strategic fund businesses, Bailey supports strong management teams that have built scalable platforms by providing strategic insights, world class advice, and access to one of the most diverse networks of industry experts. Since our founding, our senior bankers have closed over 200 transactions representing more than $17B in value. For more information see: www.bnco.com.