We’re here to help you achieve your strategic objectives.

Primary Care PPM And Private Equity Update

OVERVIEW

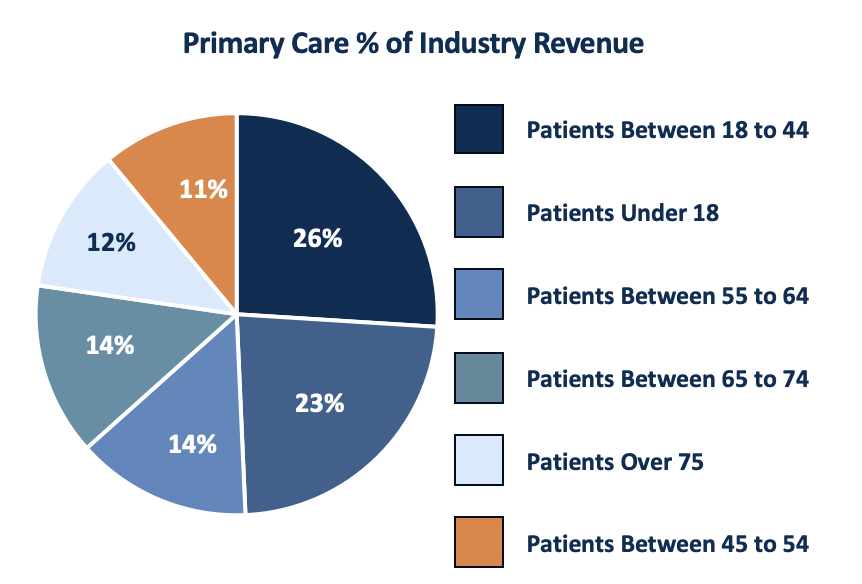

A budding area of private equity and strategic buyer interest is primary care. This sector includes a wide range of medical services comprised of general (MD, OD, and mid-level) practitioners with a broad understanding of all illnesses and ailments. As with many healthcare verticals, primary care patient demand has largely been driven by a growing aging demographic, however, the largest portion of industry revenue (>26%) continues to come from the 18 to 44 age bracket, and mainly from routine examinations. Other demand drivers include the increasing number of individuals with access to private health insurance and increased federal funding for Medicare and Medicaid which makes up nearly 20% of the industry’s payor mix. The primary care sector is highly fragmented with numerous smaller provider groups lacking access to capital limiting their ability to implement new technologies and grow their catchment areas through de novo growth. Another key characterization that has presented itself over the last twelve months has been the industry’s rapid shift away from fee-for-service models and towards value-based care (“VBC”) reimbursement where providers take on some or all of the risk.

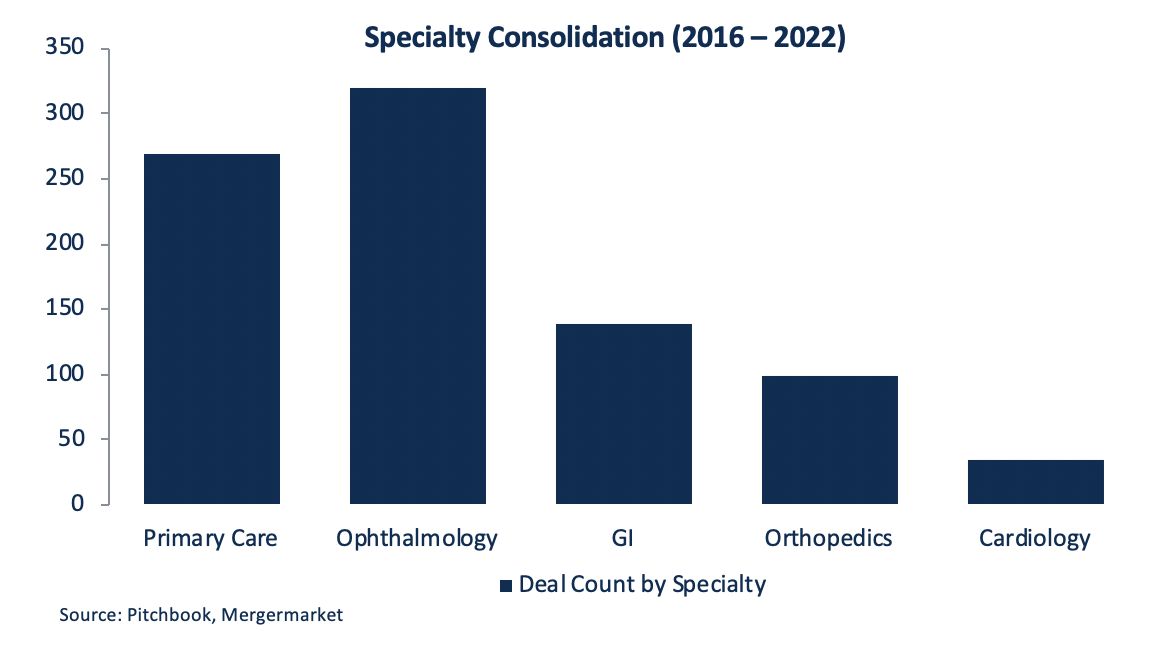

Due to the above factors, consolidation in the sector has started to accelerate. This has further been driven by sellers’ desires to realize the benefits associated with access to capital as well as back-office support. Buyer interest has focused on practices with a strong management team and, in part, its focus on adapting a VBC model. Buyers have valued certain primary care assets on their ability and potential to convert VBC, risk-based, dual eligible, and Medicaid contracts with some deals even being structured using a multiple of the Medicare Advantage (“MA”) patients rather than a more traditional approach based on earnings.

INDUSTRY:

Current primary care industry revenue is $308.3B which has grown at a 1.4% CAGR from 2018 and is expected to grow to $343.4B by 2028, a 2.2% CAGR.

- ~1M primary care practitioners in US.

- 160K primary care practices in US.

- 3.0% CAGR of the number of people >65 from 2018 to 2023.

- California is home to the most practices (>23K).

- Texas maintains the highest primary care revenue with $23B.

- >100K physicians moved from independent practice to larger groups between 2019 and 2021.

MARKET:

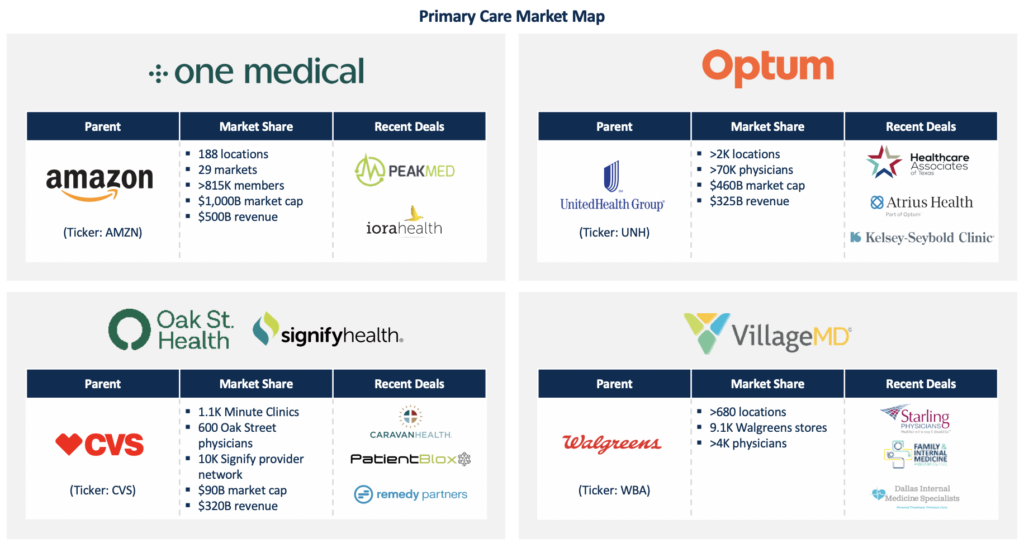

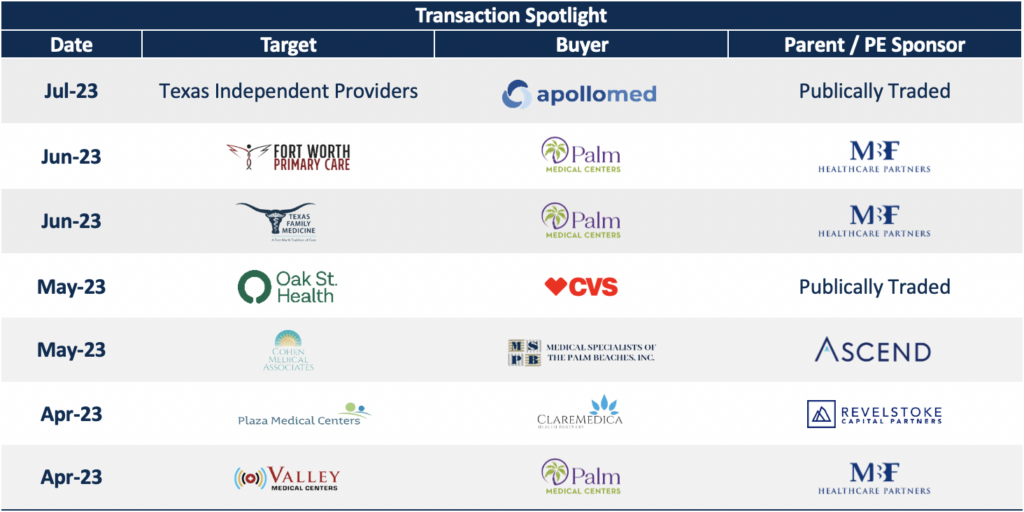

Unique to primary care, industry consolidation has primarily been led by publicly traded strategic buyers shifting away from “minute clinics” toward full-service primary care practices. Major players include One Medical (Amazon), Oak Street Health (CVS), Signify Health (CVS), Optum (United Health Group), and VillageMD (Walgreens). Larger PE-backed players also remain active in the space looking to capitalize on the fragmentation of smaller assets. Palm Medical Centers, backed by MBF Healthcare Partners, has been the most active in the space in 2023. Additional incentives, as mentioned, include the industry’s wide-spread adoption of VBC arrangements, as well as business owners looking to partner with a large group with back-office sophistication and ability to grow.

CONTACT INFORMATION

Stephen Scott

Managing Director

Richard Jacques

Managing Director

Russell Bryan

Managing Director

Phillip Knotts

Managing Director

ABOUT BAILEY & COMPANY

Bailey is a Nashville-based merchant banking platform focused on growth and late-stage healthcare and technology companies. Through the firm’s M&A advisory and strategic fund businesses, Bailey supports strong management teams that have built scalable platforms by providing strategic insights, world class advice, and access to one of the most diverse networks of industry experts. Since our founding, our senior bankers have closed over 200 transactions representing more than $17B in value. For more information see: www.bnco.com.

ABOUT BAILEY & COMPANY

Bailey is a Nashville-based merchant banking platform focused on growth and late-stage healthcare and technology companies. Through the firm’s M&A advisory and strategic fund businesses, Bailey supports strong management teams that have built scalable platforms by providing strategic insights, world class advice, and access to one of the most diverse networks of industry experts. Since our founding, our senior bankers have closed over 200 transactions representing more than $17B in value. For more information see: www.bnco.com.