We’re here to help you achieve your strategic objectives.

2025 McDermott HPE Miami Conference Recap

Introduction

Bailey & Company’s senior team was in Miami for the McDermott HPE Miami Conference (HPE), March 5-6. With attendance over 2100, up around 25% from last year, the conference has now supplanted JPM as one of the most important events for the healthcare private equity ecosystem (though we don’t foresee JPM being fully replaced any time soon). Bailey was a title sponsor of the event and brought a large delegation including five clients for fireside chats and management meetings. The optimism we recorded at JPM has cooled somewhat over the past two months, largely due to macroeconomic and regulatory uncertainty, but we think this narrative is easy to over-generalize. Some pockets of the market are seeing a material acceleration in activity, and our own deal closings and pipeline align with previous expectations for an uptick in deals hitting the market in Q2.

Deal outlook

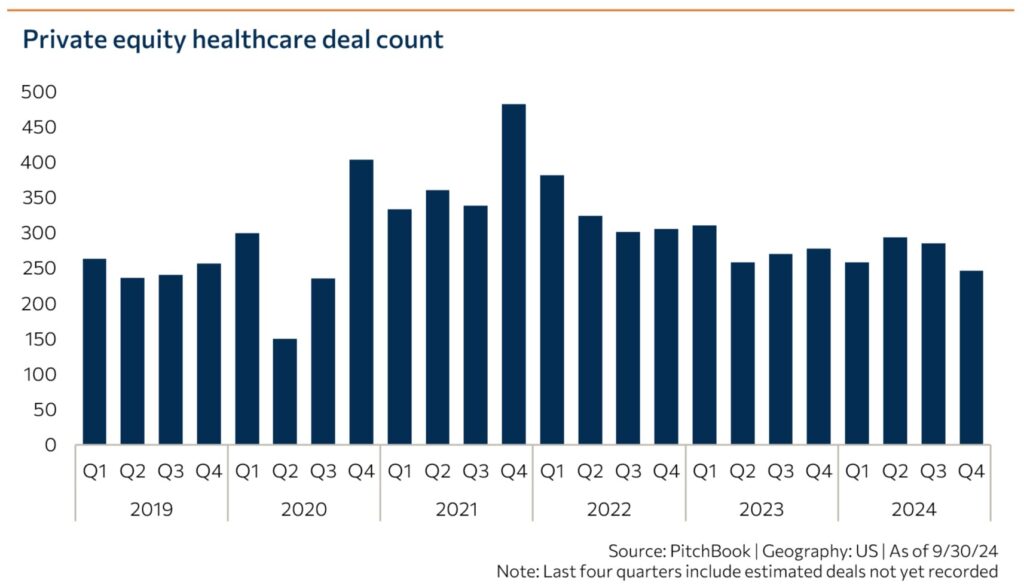

We heard numerous sponsors express frustration that the pipelines bankers advertised at JPM have not yet materialized into deal flow, with many bankers pushing previously touted Q2 launches out to Q3, Q4, or early 2026, or declining to state concrete timelines. There is some variation by group; a handful of investment banks (Bailey included) are still active and on track to launch processes before the end of H1. After being virtually closed from mid-2022 through to late 2024, the top of the market is seeing strong deal flow, with additional large assets taking banker pitches in Miami. To take one example, ModMed’s majority trade at a rich multiple was an encouraging sign on the eve of the conference.

The same complaint about deals promised at JPM not materializing also arose at HPE in 2023 and 2024. With less than two months between the two events, there is not much time for pitches made in December and early January to translate into deal flow, especially in a risk-off environment where the default tendency is to push timelines out in response to any uncertainty. However, digging in deeper, we find that several factors are materially different from what we saw in the previous two years:

- The general market consensus is that deals will get done for good assets and in favorable sectors, although things may take longer than previously expected. Processes being abandoned are generally for PPMs and/or assets with integration or other operational issues.

- After several slow years of capital deployment, dealmakers report they are being pushed by their investment committees to “run hard” at good assets that align with the fund’s thematic priorities. We have been seeing highly competitive processes for strong companies for a while, but we feel the sense of urgency around capital deployment continues to strengthen.

- More companies attended HPE than in previous years, and a good number of groups held fireside chats and management presentations.

- Quality-of-earnings, financial due diligence, and market research firms generally report they are busier than in several years, indicating that assets are being prepared for launch, though perhaps on longer timelines.

- The overall financial and operational health of PE healthcare portfolios is probably better than in several years. The quality of deals hitting the market is generally high, though we are also seeing some firms move to offload underperforming companies so they can close out a vintage already in carry and move on. Because company fundamentals are generally good, but the market is slow, there is unmet demand for add-ons.

- Lender sentiment is decidedly risk-on. This is discussed in greater detail below.

- Regulatory and macroeconomic uncertainty arising from the Trump administration’s posturing is the most concrete reason market participants can point to for the shift in sentiment since JPM. However, we feel that—barring extraordinary developments—the market’s nerves will likely calm on this front over the spring and summer. This is also discussed in greater detail below.

Overall, we continue to expect a gradual reacceleration of deal activity over the course of the year, though most of the volume increase will come in H2 rather than Q2 as previously expected.

Capital deployment style and fundraising

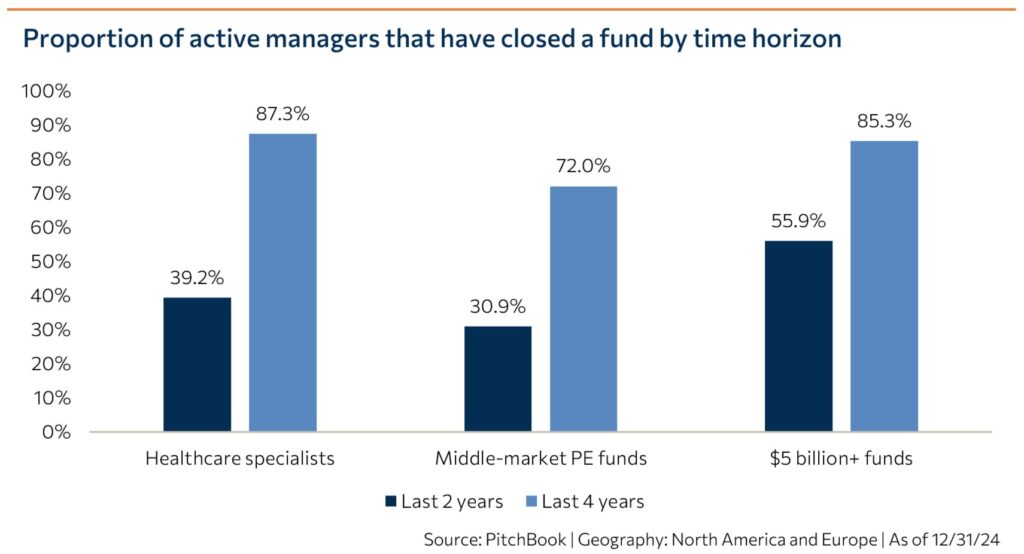

Firms that have posted a couple of strong exits are returning to the fundraising market, sometimes with a fairly quick turnaround from the previous vintage. Data shows that healthcare specialist funds have more consistently returned to market than other middle-market PE funds over the past several years. There is also a cohort of GPs that are around halfway deployed in the current vintage and need one or two more platforms to return to the fundraising trail. Firms are generally attempting to remain true to their historical investment styles, other than dialing down their PPM exposure in many cases (discussed further below).

As middle-market healthcare firms have moved upmarket, smaller funds are touting their ability to look at platforms under $5 million EBITDA as a competitive advantage. A few lower-middle-market firms with developed business development engines have successfully sourced proprietary deals in attractive subsectors. Investors that have raised larger funds continue to adjust to the need to write larger checks while staying true to the investing styles that brought them success earlier. This manifests in an openness to looking at relatively smaller platforms as long as there is a strong pipeline of add-ons available, or to combining several mid-sized companies into a larger platform.

As we noted after JPM, firms are leaning into operating executive models of various flavors, both to gain a deal sourcing advantage and to lead the firm into subsectors they are relatively less familiar with. Recruiters report that this role is in high demand.

Lender sentiment

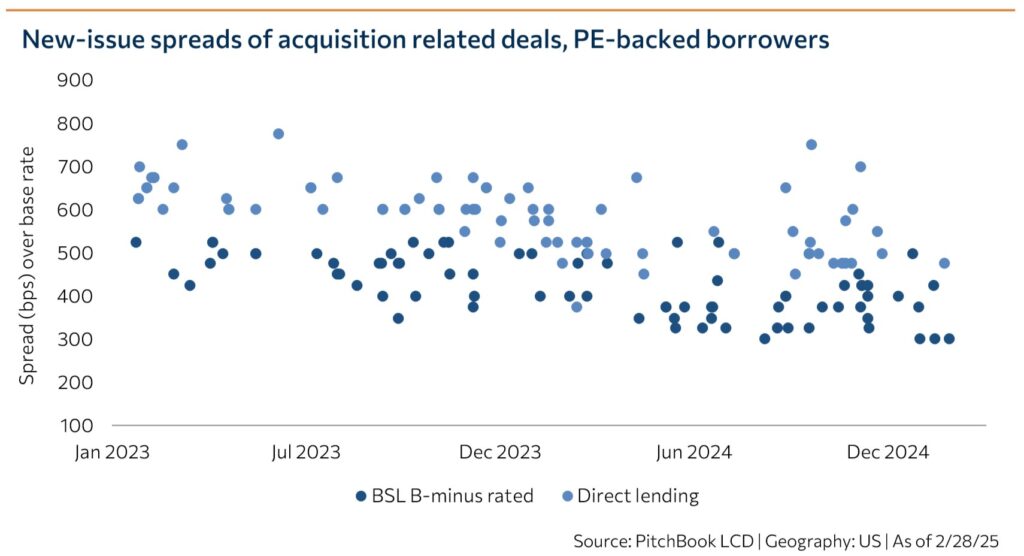

Lender sentiment continues to be risk-on as record levels of private credit dry powder, plus a reinvigorated broadly syndicated loan market, chase limited deal flow. Lenders are heavily focused on business development with sponsors, and larger processes are coming out with staples more frequently. Spreads have tightened to around SOFR+4.00 for M&A financing for good quality, PE-backed assets in the upper middle market—a new low for the past few years. With interest rates returning to a higher-for-longer holding pattern, lenders are also looking for equity co-invests and warrants to increase upside. We heard leverage ratios up to 6.5x EBITDA from an incoming lender. Dividend recaps are also getting done in some sectors.

The structured capital universe has grown significantly in the past few years, with more groups represented at HPE than in years prior. Although traditional lenders are aggressively chasing top-quality assets, structured capital sees a significant risk arbitrage opportunity to support growth and M&A with mild complexity, since company fundamentals are relatively strong, overall, compared with the past few years. For instance, structured capital investors are currently less averse to PPMs than equity investors provided the platform has sufficient scale and is in good operational health.

Regulatory and macroeconomic dynamics

It is remarkable that after a JPM in which very little time was devoted to discussing regulatory dynamics, the Trump administration’s capricious first two months in office has once again elevated macroeconomic and stroke-of-the-pen risk in investors’ minds. We detail the outlook in various areas below, but overall believe that the market’s skittishness will subside as the year progresses. Time will provide clarity on which of the administration’s directives are actually going to be implemented, which will be drastically pared back, and which will be blocked by the courts. Additionally, just as investors have become comfortable with uncertainty around interest rates, we believe they will eventually embrace some level of federal regulatory risk as baked in (at least until the midterms), shaping sub-sector investment priorities accordingly.

Medicaid

Medicaid funding was by far the most frequently referenced area of regulatory concern at HPE. In late February, the House adopted a budget proposal that included instructions for the House Energy and Commerce Committee to cut spending under its jurisdiction by $880 billion. Estimates from the Congressional Budget Office implied that much of this would have to come from $8.2 trillion of Medicaid spending over 10 years if Medicare were left untouched.

Additional messaging by the Trump administration, policy research, and our conversations with regulatory experts lead us to believe that there is much less risk than the $880 billion headline would suggest. Although high-level chatter is skittish on Medicaid, we believe many investors who are digging into the specifics are beginning to come to a similar conclusion. Specifically:

- Following the budget proposal, President Trump stated that he “won’t touch Medicaid” and that the administration will instead focus on reducing fraud. House Speaker Mike Johnson and other Republican representatives quickly followed suit. “Reducing fraud” is likely to take the form of increased frequency of enrollment verification as well as work requirements via 1115 waiver, which were a feature of Medicaid under the first Trump administration. The most immediate impact of these initiatives would be on Medicaid managed care organizations, since beneficiaries that are high utilizers are more likely to ensure they have adequate documentation in place to maintain access to care.

- Additional measures to allow the administration to point to spending cuts could include repealing the Medicaid 80/20 rule (already facing legislative and likely legal challenges) and reducing the provider tax.

- Policy experts believe that Republican governors of Medicaid expansion states will pressure Trump not to slash the federal matching rate (Enhanced FMAP). Eliminating Enhanced FMAP would increase state Medicaid spending on acute care by 14-33% for expansion states with Republican governors, depending on the state, absent changes in eligibility. In a recent KFF poll, 65% of rural Republicans said they want Congress to maintain or increase Medicaid spending levels.

- Any significant changes to Medicaid policy are likely to be processed through the federal budget reconciliation process, which will play out over the spring and summer.

It is also important to note variations by sub-sector and state. Providers serving vulnerable populations with access challenges (e.g., behavioral health) are likely at less risk than other specialties, such as dentistry. Current investor tolerance for Medicaid risk is also higher for more in-demand assets (e.g., PHP/IOP, infusion). We spoke with some investors who feel comfortable with specific Medicaid investments where the combination of limited access and lower-than-average reimbursement in a given state would suggest that any rate movement is likely to be upward (e.g., ABA in Texas).

Federal antitrust

The day before last year’s HPE, Lina Khan’s FTC, along with the DOJ and HHS, had announced their tri-agency “inquiry on the impact of corporate greed in healthcare.” While the Trump administration’s FTC is universally expected to be less activist, some friction remains at the federal level. HSR requirements continue to frustrate in larger deal processes.

The new FTC is not entirely doveish. On March 6, the agency announced a lawsuit to block GTCR’s take-private of medical device coating firm Surmodics on the grounds that it would eliminate competition between Surmodics (the number one player) and Bicoat, the number two player already in GTCR’s portfolio. GTCR has not publicly announced plans to merge the two companies. On a more positive note, Owens & Minor launched financing for its acquisition of Rotech, signaling that the company expects the deal to close in H1 following a second request for information in October 2024.

State antitrust

California governor Gavin Newsom’s veto of AB 3129 in October 2024 appeared to mark a turning point in state-level regulation of PE investment in healthcare—but the landscape of pre-merger notice laws, and potentially even more restrictive measures, continues to develop. Most notably, CPOM-related components of AB 3129 have reappeared in the form of SB 351, and Oregon’s legislators have reintroduced a proposal to scuttle MSO structures that failed to pass last year. Pre-merger notice laws have also been introduced or strengthened in several states since the start of the year. In Indiana and Illinois, which already had transaction reporting laws, there are now proposals requiring attorney general consent for some transactions. As we have noted previously, grassroots organizations that formed over the past year or two to oppose PE investment in healthcare are likely to continue to be active. The PE industry is also, finally, beginning to organize more effectively to articulate its value-add in the healthcare ecosystem, supported by third-party research (PitchBook, Avalere) and industry groups such as the newly launched Association for Responsible Healthcare Investment.

These state-level anti-PE regulations are less discussed now than they were a year ago; the risk of delay and added costs for deals in states unfriendly to PE investment in healthcare is certainly real, but is more of a marginal consideration (i.e., there is a higher bar for investing in these states) than a major impediment to deal flow at this point. This may change if the more severe proposals pass without being watered down.

Interest rates

There is a real possibility that the administration’s tariff regime will reignite inflation and prompt the Federal Reserve to raise interest rates again. This was barely mentioned in conference meetings. As one attendee put it: “Rates are where they are. It’s not new anymore.”

Supply chain costs

Possibly the most underrated regulatory risk at present is the direct effect of proposed tariffs on medical supplies, drugs, and devices, many of which have supply chains concentrated in China and Mexico. Low-margin personal protective equipment, for instance, is likely to see an immediate price increase in response to any tariffs imposed. This could squeeze the bottom line for provider groups and—on the margins—may favor larger organizations with the sophistication and buying power to explore creative supply chain solutions.

Sector focus

The predominant theme in investor sector focus today: Anything “picks and shovels” is in vogue. This theme spans healthcare IT and tech-enabled services, provider services, and medtech and pharma services. Examples include services along the medical device value chain (from CDMO to maintenance, repair, and operations); managed IT vendors; pharma supply chain; testing, inspection, calibration, and compliance (TICC) of various flavors; governance, risk, and compliance (GRC); and even provider business services (e.g., laundry). If investors were chasing risk-bearing primary care and consumer-oriented digital health in 2021, the pendulum has now swung to the opposite amplitude—to market segments that are at least one or two steps removed from direct care provision and likely to see steady, if not runaway, growth in line with overall healthcare spending.

Healthcare IT and tech-enabled services

Healthcare IT remains at the top of many investors’ priorities, and it was noteworthy that numerous tech bankers were in attendance at HPE despite HIMSS occurring in Las Vegas the same week. Some firms that once invested exclusively in services have now built healthcare IT and tech-enabled services teams. Revenue cycle management (especially specialty) and GRC (discussed below) continue to come up repeatedly. We also heard interest in specialty EMRs and practice management platforms.

Pharma services and life sciences

Our sense is that, after a two-year run of being the most in-demand healthcare vertical, pharma services has slipped to the number two priority behind healthcare IT. Experienced life sciences investors—comfortable with taking on more scientifically advanced due diligence—are still finding actionable opportunities, particularly in areas such as pharma and medtech CMO and generics. Among the more traditional healthcare services-oriented firms comfortable with a “lighter” approach to the life sciences, there are those who grabbed clinical trial site and commercialization assets early on, and those who have found deal sourcing difficult since. Interest in traditional site management organizations has cooled slightly due to intense competition and one prominent process faltering, though we think there is still untapped opportunity in embedded site models. Technology-differentiated commercialization, specialized consulting (regulatory affairs, pharmacovigilance) and patient recruitment and access plays remain attractive.

Payer tech and services

As mentioned below, we continue to see significant sponsor interest in payer tech-enabled services serving both the government-pay and employer-funded end markets. Cost containment, including specialty utilization management, is a recurring theme and active market. Investor interest in the employer-funded health and employee benefits space is high and far exceeds the number of actionable opportunities. Platforms in this space must solve for two key challenges: distribution channel and point solution risk. This makes tech-enabled services assets in benefits administration, brokerage, consultancy, and professional employer organizations (PEOs) a good entry point.

Healthcare services

Among provider plays, ABA is undoubtedly seeing a resurgence of interest following several positive precedent transactions and a few years of operational course correction for existing platforms. Mental health PHP/IOP remains in high demand but perhaps less talked about than a year ago, possibly due to a dearth of available assets. Investors are increasingly looking at SUD PHP/IOP and mixed residential/outpatient models as alternative entry points. Infusion also continues to be in high demand, with some investors backing away from the space due to elevated valuations. Interest in home health, hospice, and private duty home care is steady. Post-acute staffing models, including primary care, geriatric psychiatry, and rehabilitation, are generating considerable interest.

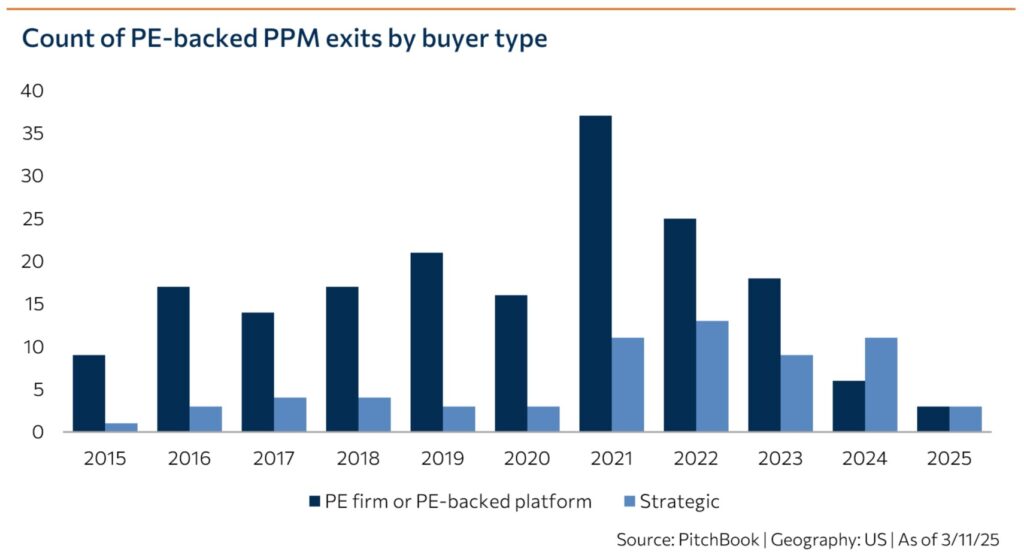

The narrative around PPMs has shifted over the past year from nearly universal aversion to a possible “contrarian play” to something more benign: Openness to investing in PPMs simply depends on the degree of exposure in the current portfolio. The emergence of large distributors as strategic buyers has provided some encouragement to the market; the ambulatory surgery center (ASC) aggregators and Optum also remain active. We expect that orthopedics, gastroenterology, ophthalmology, and even medical dermatology will see some movement this year. Those contemplating PPM deals are interested in alternatives to traditional MSO physician equity structures, including JVs and W2 employment.

Services into providers that do not involve direct care delivery—including consulting and MSO services—should continue to be active this year.

Market feedback on select thematic research topics

Bailey & Company’s market research platform provides deep, actionable insights into areas of emerging market opportunity. At HPE, we had numerous follow-up conversations around some of our recent thematic research reports that allowed us to further evaluate market sentiment around these topics.

GRC

Within HCIT, GRC continues to sit atop the priority list for many sponsors. GRC aligns with the market’s favorable view toward “picks and shovels” investment themes and benefits from virtually zero stroke-of-the-pen or reimbursement risk. We find that sponsors’ definitions of GRC are quite broad, with some leaning into the traditional credentialing and provider data functions and others focusing on adjacencies such as education and vendor management, depending on the firm’s prior experience. With several actionable platform opportunities coming to market in the next 1-2 years, we are fielding frequent conversations on M&A strategy and logical add-on targets. The market’s view on GRC is that the incumbent players are not (yet) unassailable, and investors are seeking paths to assemble new horizontal platforms. There is also some interest from upmarket firms in combining existing large platforms.

Tech-enabled payer services for value-based care (VBC)

In January, we published an article arguing that vendors serving the payer market with care gap closure, stars/HEDIS improvement, member engagement/activation, and risk coding solutions would be in high demand starting in 2025 due to elevated member churn among MA plans. Since we published this piece, which was based on proprietary conversations with market participants, we have seen several publications released that support this assertion with concrete data, including reports from Deft Research and Health Enterprise Partners. Investors are also taking note; payer tech-enabled services cropped up in numerous conversations at HPE. A related theme: Although few investors are looking for a new entry point into VBC primary care, PE-backed clinic aggregators that weathered v28 relatively well (i.e., that serve populations with relatively lower risk scores) are actively seeking opportunistic M&A.

Individual Contribution Health Reimbursement Arrangements (ICHRA)

The subject of our most recent research release, ICHRA generated considerable buzz and investor curiosity at HPE. A few growth-oriented firms have been actively pursuing ICHRA administrators as platforms, and we expect additional opportunities to hit the market soon. Most firms, however, are interested in ICHRA as a competitive dynamic that could affect existing investments in third-party administrators (TPAs) and captives, or as a growth lever that can be added onto a more stable benefit administration, broker/consultant, or PEO platform. We foresee actionable opportunities of this kind in the coming years as the solution set for the small- to midsize employer market matures.

ABOUT BAILEY & COMPANY

Bailey is a Nashville-based merchant banking platform focused on growth and late-stage healthcare and technology companies. Through the firm’s M&A advisory and strategic fund businesses, Bailey supports strong management teams that have built scalable platforms by providing strategic insights, world class advice, and access to one of the most diverse networks of industry experts. Since our founding, our senior bankers have closed over 200 transactions representing more than $17B in value. For more information see: www.bnco.com.